|

BIZCHINA> Review & Analysis

|

|

Overcapacity blights both EU and China economies

(China Daily)

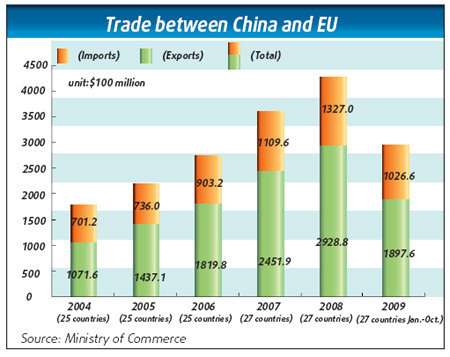

Updated: 2009-11-30 07:46  China meets Europe today in Nanjing for the annual EU-China summit. This is the most important event for the EU in China this year. So how is the relationship, and what can we do to improve the relationship between the largest trading bloc in the world and the biggest economic comeback story in human history?

The politics of EU-China commercial relations hit a low in late 2008, but now there are signs that both parties have found their way back into a dialogue. Fortunately, confrontation is no longer the order of the day with both sides looking inward to try and fix their economies. Given the challenges from rising unemployment in Europe and greater assertiveness by some interest groups in China with regard to solidifying monopolies, trade and investment liberalization is not a very popular policy in either Beijing or Europe's capitals. There have also been many positive signals. With regards to helping SMEs, the EU moved fast and strengthened its IPR Help Desk for the sector in Beijing. On the Chinese side, the Ministry of Industry and Information Technology developed a number of important policies for SMEs in China. There remains one major problem affecting both governments - the overcapacity in the global economy. The central government in Beijing is already moving to tackle this issue. On August 26th this year, the State Council released a statement noting that overcapacity had become a serious problem in many industries. The government singled out six industries - iron and steel, cement, flat glass, coal chemical, poly-crystalline silicon and wind power equipment. Measures to control these sectors now include tighter market entry, reinforced environmental supervision, tougher controls over land use and stricter lending standards. Report on overcapacity The European Chamber welcomes and fully supports these policies. Last week the chamber launched a study that provides insights into the problem of excess capacities, and most importantly, recommendations on how to overcome this problem.

Meanwhile, as banks bankroll the addition of unnecessary capacity in certain industries, the threat from non-performing loans is growing. At the same time, the global impact already can be felt in the form of growing trade tensions. Since trade frictions hamper supply chains, this is a major threat to globalization's positive effects. According to the findings of our study, overcapacities are driven by High savings, particularly driven by retained earnings from State-owned enterprises Collapse of demand in export markets, primarily in the United States Low domestic consumption Weak enforcement of regulations Low input prices due to government policies Too low capital costs in China A fiscal system that encourages local government to attract excessive investment Local protectionism Inexpensive and widespread availability of technology Regionalism driving industrial fragmentation Environmental, health and safety standards and laws not fully implemented Philosophy of market share vs. profitability The study has found that the recent measures taken by the Chinese authorities to curb overcapacity are a positive first step. However, the European business community in China sees further possibilities for improvement and offers more than 30 recommendations, including: Strive to cut capital expenditure Increase SOE dividend payment and redistribute to Chinese households (indirectly through government spending on social security, healthcare and education) Increase government spending on pension and healthcare systems in order to provide the social "safety net" which would enable households to consume Allow market access for specialized, efficient private financial service providers, by encouraging both SME and private (venture) capital Reform the fiscal system to give local regions more funding possibilities Further open-up the service industry to the private sector and encourage stronger competition in the service sector Improve intellectual property protection so that innovations are protected and Chinese companies are given incentives for increasing R&D spending Enhance the business environment for SMEs Implement more rigorously environmental, safety and health standards and labour laws Adjust the relative input prices by increasing resource and environmental charges Reduce energy price subsidies to industry and continue resource price reform, by focusing on areas like coal resource tax, electricity price, water and natural gas price Gradually appreciate the RMB We need a tangible outcome from this meeting, to prove that this is not just another talking shop. I am fully confident that this can be a solutions-focused summit. The European Chamber will do everything to make that happen. The story is contributed by Joerg Wuttke, president of European Union Chamber of Commerce in China. (For more biz stories, please visit Industries)

|