Energy

Plans to harness new natural gas resources

By Chen Jialu (China Daily)

Updated: 2010-06-22 13:44

|

Large Medium Small |

|

|

As climate change is alarming policymakers, a string of oil companies are eyeing to harness China's plentiful unconventional natural gas resources, such as coalbed methane gas, deeply locked in China's bountiful coal reserves which is expected to reduce China's reliance on natural gas imports for decades to come.

Chinese companies such as the State-owned oil giant PetroChina, as the obligatory partners of any foreign company wanting to invest in coalbed methane in China, are aggressively extending joint ventures with overseas energy companies to shore up the country's unconventional gas reserves.

The Chinese companies establish a Production Sharing Contract (PSC) with foreign contractors rather than a conventional joint venture arrangement which is seen in mining and manufacturing.

Enviro-Energy International Holdings Ltd, a Hong Kong-listed energy company operating through their non wholly-owned subsidiary company TerraWest Energy Corp, is betting that they can tap unconventional sources of natural gas in China by joining with PetroChina and applying new techniques to drill into the vast new coalbed methane resources in Northwest China's Xinjiang Junggar Basin, develop the coalbed methane resources and capitalize on the potential of this new clean energy. TerraWest Energy Corp holds a 47 percent interest in the PSC administered by PetroChina Coalbed Methane Company Ltd.

Junggar to produce CBM

Enviro Energy, as a frontrunner in exploiting China's coalbed methane gas, said their flagship coalbed methane project in Xinjiang covers 653 square km in the southern Junggar Basin, which contains an estimated 69 trillion cubic feet (1.95 trillion cubic meters) of the gas, will start pilot production as soon as late this year.

"We expect pilot production to begin later this year and continue into next year," chairman of Enviro Energy, Kenny W. Chan told China Daily in an exclusive interview earlier this month.

Commercial production would follow pilot production after the planning is completed in cooperation with PetroChina, he said.

The gas will supply the local growing gas market in the Urumqi city area of Xinjiang as well as feed into the West-East Gas Pipelines which span the country from northwestern Xinjiang Uygur Autonomous Region to the eastern city of Shanghai and to Guangdong in the south.

"We are not so much concerned with our buyers and markets," says Chan.

Chan said the coalbed methane resources in Xinjiang's Junggar Basin hold an optimistic business prospect, based on thick and extensive coal seams, high-quality gas content and mature natural gas infrastructure in place. Forecasts for high energy demand in the region have been further supported by the recent central government announcement to boost economic development in Xinjiang Uygur Automous Region.

"The speed of pushing ahead with the coalbed methane project in China is even faster than in US," said Chan. "I think China will catch up in CBM exploration quickly, " he said.

Chan expects the value of China coalbed methane assets to soar as exploration moves ahead to piloting and then production in Xinjiang and elsewhere.

Under the PSC, the Jungar basin coalbed methane project is a joint venture between PetroChina and Terrawest. Enviro Energy holds a 65.58 percent stake in Terrawest. Terrawest executed the PSC with China United Coalbed Corp Ltd in December 2005 and the contract is now administered by PetroChina Coalbed Methane Co Ltd.

Chan also said they are in talks with Terrewest to increase their stake in the project.

China, a huge CBM reservior and market

"The coalbed methane gas extracted from coal reserves can transform a dirty, carbon-heavy by-product of a dangerous mining industry into a relatively clean and potentially competitive fuel," Chan said.

"Coal Mine Methane Gas build-ups are one reason for China's high tally of mine accidents, so the creation of commercial incentives to release accumulated gas could not only bolster the industry's safety record, but also reduce CO2 emissions and pollution," said Chan.

Exploration in the southern Junggar Basin has uncovered additional shallow gas potential in other rocks which surround the coal seams. The gas in carbonaceous mudstone, or shale, is of great interest. "All the gas resources create the potential for a huge project, " Chan said. But he added that research and exploration work are still underway and the exact capacity of the other gas stored in the reservoir cannot yet be released.

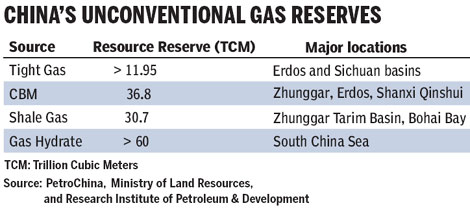

China is also starting to develop deposits of shale gas, although the sector is still in its infancy. PetroChina estimates China may have as much as 45 trillion cubic metres in shale gas - more than Russia's proven gas reserves last year.

"The growth of unconventional natural gas production in North America over the past 10 years illustrates the potential in China," said Chan, who worked in the industry in North America for nearly 30 years before he set up his company in Hong Kong in 2007 to do energy-related business on Chinese mainland.

US coalbed methane output went from zero in 1990 to over 1.1 trillion cubic feet (31 billion cubic meters) in 1999, accounting for 57 percent of the growth in domestic gas production over the period.

Unconventional natural gas types are: tight gas, coalbed methane, shale gas, and gas hydrate, among which coalbed methane has been developed fastest and has the longest history of development in China.

China is the world's biggest coal producer and consumer and China's proven reserves of coalbed methane are estimated to reach 185 billion cubic meters, ranked as the world's third largest, following Russia and Canada, according to the Ministry of Land and Resources.

Howerer, China has lagged far behind US and Canada in realizing its huge coalbed methane potential, Chan said.

He said PetroChina's production of coal seam gas would reach 10 billion cubic meters by 2020.

"The additional output will be mainly supported by new projects in northern China," Jie said.

"Coalbed methane exploration and development is still at an initial stage, but new policies effectively encourage its exploitation and utilization," Jie Mingxun told a forum in Singapore earlier last month.

Enterprises related to coalbed methane surface extraction shall enjoy temporary resource tax exemption. Coalbed methane exploitation enterprises are currently subsidized by the central budget at 0.2 yuan/m3, Jie said.