World Business

Nestle to expand in emerging markets

By Tom Mulier and Shin Pei (China Daily)

Updated: 2010-07-01 09:39

|

Large Medium Small |

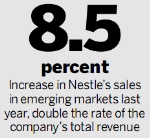

Nestle may purchase bottled water businesses in markets such as China, Frits van Dijk, head of Nestle's Asian business, said on June 22. Acquisitions would also be considered to expand its business selling nutrition products for athletes such as PowerBar, Nestle Nutrition CEO Richard Laube said.

Possible targets may include Synutra International Inc, the $950 million Chinese infant-formula company, according to Katherine Lu, an analyst at Oppenheimer & Co. Nestle should consider buying natural pet-food makers to better compete with Procter & Gamble Co, which agreed to buy Natura Pet Products Inc on May 5, or enter new bottled water markets in India and Africa, said James Targett, an analyst at Consumer Equity Research.

|

Nestle Waters CEO John Harris said on June 18 the company has a list of five new markets that it would like to enter.

"The cash lets Nestle have the stomach to invest behind their existing businesses and markets," said Thomas Russo, a partner at Gardner Russo & Gardner in Lancaster, Pennsylvania, which holds more than $350 million of Nestle shares for clients. "They have the field pretty much to themselves at the moment."

Nestle spokesman Ferhat Soygenis declined to comment.

Bulcke has made only one purchase of more than $1 billion since taking over as CEO in April 2008, the $3.7 billion purchase of Kraft's North American frozen pizza business announced one day after the Alcon sale. The CEO has pledged to spend as much as 3 billion francs a year on acquisitions of smaller companies, and Nestle has said that the company does not need to make "transformational" purchases.

The cash due from Novartis is enough to buy any of Nestle's rivals in food and non-alcoholic beverages save the six biggest. That includes adding a 22 percent average premium that Nestle paid for its acquisitions of listed companies since 2000.

"They're going to use the money to buy assets, at least a big chunk of it," said David Hayes of Nomura. According to Hayes, Nestle may look at General Mills Inc, the maker of Betty Crocker cake mix, which has a market value of $24.8 billion.

|

||||

H.J. Heinz Co or Hershey Co could also be targets for Nestle, Euromonitor said in a May 20 report.

Heinz would allow scope for lower costs in culinary aids and baby food, and Hershey would strengthen Nestle in its weakest region for chocolate, the market research company said. Heinz has a market value of about $14 billion and Hershey is valued at $11 billion.

Nestle should avoid buying big companies that would make managers spend too much time selling assets to satisfy antitrust regulators, Thornburg's Trevisani said.

Bloomberg News