Opinion

Economic advice for policymakers

By Ma Jun (China Daily)

Updated: 2010-07-20 13:34

|

Large Medium Small |

China has started formulating its 12th Five-Year Plan (2011-2015) by soliciting the advice of officials and economists. The focus of the previous four five-year plans was on setting economic growth targets, which was usually surpassed by growth in real terms.

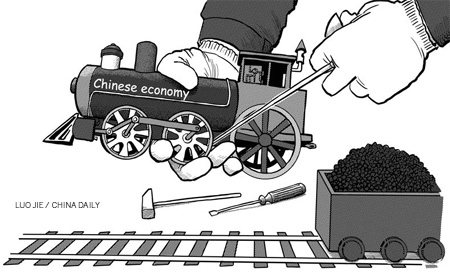

Relative to the established goal, China's economy has always been overheated, because regardless of whether the central government set a growth target or not local governments have shown more enthusiasm in pursuing fast rather than planned growth. Under such circumstances, it is more important to maintain macroeconomic stability, instead of staring at a planned growth target, for volatility is what an economy fears most.

Major macroeconomic fluctuations in China have been caused mainly by internal factors, except for occasional external ones such as the global economic crisis and the 1997 Asian financial crisis.

If China's economy, fueled by fast rising investment and bank loans, continues to overheat with emerging inflation and assets bubble, the central government has to take macro-control and tightening measures to cool it down, which in turn would result in economic downturn, unemployment and other social tensions. To reduce these pressures, the central government has to announce a new round of stimulus. This type of economic growth model is unendurable.

Accordingly, finding ways to prevent the government-led economy from overheating has always been the biggest challenge for the country's policymakers. To achieve macroeconomic stability, four drawbacks in the system have to be rectified.

First, the system to appraise local governments' performance, which acts as an incentive for officials to pursue fast GDP growth, should be changed. Overheating of the national economy has almost always been caused by excessive investment by local governments. Once the central authorities loose the money supply, the impulse of local investment is bound to grow. So, to achieve macroeconomic stability the incentive mechanism of local authorities has to be changed.

| ||||

In an ideal system, local governments' performance should not be judged on the basis of fast GDP growth at the cost of social causes and the environment. On the contrary, governments ignoring social causes and violating environment protection laws should be punished. This would help the governments' function to change from direct engagement in economic activities to providing public services.

Second, the central bank should be granted more independence in drafting the monetary policy. China lags behind many countries when it comes to tightening the monetary policy independently (such as raising the interest rate). A good monetary policy should be based on proper perspective. What the central government needs to do is to set a target for currency growth and then authorize central bank officials to handle the concrete financial instruments.

Third, the number of administrative decrees in macroeconomic regulation should be reduced and more economic leverages, including the interest and exchange rates, employed. Though the country has been implementing market-oriented reform for three decades, credit increase still depends on quota control and project investments are still subject to official approval. Flexible interest and exchange rates and other economic measures, which are useful macro-control tools used in mature markets, are not the favorites of Chinese policymakers.

But the policymakers need to realize that excessive reliance on administrative measures is not at all conducive to economic stability. Only after bubbles had been seen in sectors such as real estate, industries with overcapacity and local financing institutions, did the authorities intervene and raise investment thresholds. Such a step could cause major fluctuations in certain industries or even the whole economy. Moreover, a large number of administrative restrictions which only offer investors special opportunities will inevitably lead to more corruption.

Fourth, the country should expedite efforts to strengthen the social security system in order to minimize the side effects of macroeconomic policy adjustments. One important reason why China had to announce an ambitious stimulus package even when its GDP growth rate was far higher than other countries is that it feared a rise in unemployment could lead to serious social unrest. The reason of this fear: lack of a sound social security system.

China should accelerate its reform according to current strong social consensus on balancing income distribution. And the State-owned Assets Supervision and Administration Commission should transfer the majority of its holdings in listed State-owned enterprises (SOEs) to the social security system in order to raise pensions and grant retirement benefits to people in as many sectors as possible. And the government should use more dividends from the SOEs to make up for endowment, health and unemployment insurance and reduce personal income tax.

The author is the chief economist for Greater China at Deutsche Bank