Economy

Luxury products win mass appeal

By Bao Chang (China Daily)

Updated: 2010-08-02 09:08

|

Large Medium Small |

|

|

|

A board advertising Hugo Boss clothes at a discount rate of between 50 and 80 per cent in Binhu Street, Hangzhou, Zhejiang province, where hundreds of international clothes brands have opened outlets. [Bao Zunyuan / China Foto Press] |

BEIJING - Luxury brand makers are struggling to find the right sales strategy in China after the country was named the second largest market in the sector.

Debate is raging over whether to maintain their exclusivity or to allow them to become more commonplace.

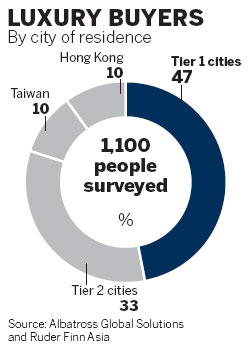

The Japanese lead the field in terms of luxury goods purchases. The Chinese follow, spending $9.4 billion in 2009, accounting for 27.5 percent of total global sales. The United States is in third place.

"For traditional luxury goods brands, there are two directions," said Denis Morisset, a director at Ecole Superieure des Sciences Economiques et Commerciales (ESSEC). "One is the elite path. The other seeks popularity among ordinary consumers. At present, no obvious barrier exists between these two directions."

Hermes, for the first time in the brand's history, is set to launch a new brand called Shang Xia in China this fall. According to the company, the first Shang Xia store will be opened in Shanghai selling tableware and furniture. The products' design, brand management and craftsmanship would be localized with Chinese characteristics built into the brand for Chinese consumers.

Some analysts believe Shang Xia products would be cheaper than the company's main brands because of their localization, but may dilute the Hermes name, which is famously attached to its Kelly and Birkin bags which retail at $10,000 to $60,000.

However, the Financial Times quoted Florian Craen, Hermes managing director in north Asia, as saying that while Hermes was a Parisian company, Shang Xia would be completely different.

While top-tier shopping malls are mostly situated in Beijing's central business district, there is a luxury goods outlet called Beijing Scitech Premium Outlet Mall in the suburbs near the airport which attracts many Chinese customers because it offers high-end brands at discount prices.

One of the shops at the discount mall, Coach, offers a 30 percent discount on new handbag collections and also some off-season products at special prices around 2,000 yuan ($295.20). Major products are priced between 2,000 and 7,000 yuan in the store. The sales volume of the store is around 300,000 yuan per day.

There are more than 20 stores selling international brands in the mall, including Burberry, Ports, Dunhill, Bally, CK and Puma.

Zhou Mi, a 26-year old student at a Parisian business school, who is spending his summer holiday in Beijing, said: "It's totally different from the outlet in France. The outlet near Paris only sells luxury brands rather than CK products, which are very common in Europe."

Luxury goods consumers in China are younger than their counterparts in Western countries and Japan. According to research by Ipsos France, most consumers of luxury goods in China are aged between 25 and 40 with monthly salaries between 5,000 and 50,000 yuan.

|

||||

However, Morisset at ESSEC is worried about the future of global luxury brands. He said that the larger the sales volume, the more profit the company makes. However, the exclusivity of luxury goods would disappear as more and more people owned them.

To maintain their cachet, Morisset said a unique service should be provided to their VIP customers.

Laurent Schenten, director of the International Customer Division at Printemps, a top-tier shopping mall in Paris, agreed with Morisset.

"The real luxury aspect is not limited to the product itself. The notion of service and shopping environment are also very critical," Schenten told China Business Weekly.