Economy

Purchases set to ease trade frictions

By Ding Qingfen and Tan Yingzi (China Daily)

Updated: 2010-09-16 09:11

|

Large Medium Small |

China urges US not to sacrifice relations for political expediency

BEIJING/WASHINGTON - Chinese trade delegations, visiting or set to visit the United States to purchase goods and services, will help strengthen economic ties between the two countries, the Ministry of Commerce said on Wednesday on the eve of a US congressional hearing about trade relations with China.

Ministry spokesman Yao Jian said one delegation headed by Vice-Minister of Commerce Wang Chao and comprising almost 50 business leaders, left Beijing for the US on Tuesday.

They will seek trade and investment opportunities in such areas as energy and technology. Two more delegations will fly to the US by the end of this year, Yao said.

The announcement came less than 24 hours ahead of a hearing by the US House Committee on Ways and Means that aims to pressurize China to increase the value of its currency. Some US critics said an "undervalued" yuan was a major cause of the US trade deficit with China.

However, the Ministry of Commerce said the accusation did not make any sense and urged the US not to politicize economic issues.

"China does not want to see a few US politicians blame China's trade, especially currency policies, just for their own political need to win the upcoming US midterm elections," Yao added.

The US congressional elections will be held in November and with a high unemployment rate and slow economic recovery some politicians have blamed China and its currency policies to win more votes.

US Treasury Secretary Timothy Geithner told the Wall Street Journal on Sept 10 that China had made "very, very little" progress on letting the exchange rate reflect market forces and he was not satisfied with China's progress on the yuan. He is scheduled to present the Obama administration's latest view on China's foreign exchange rate on Friday.

However, Li Daokui, adviser for the People's Bank of China, said on Wednesday he does not see the conditions for a large appreciation of the yuan because China's trade surplus is already shrinking.

Speaking at the Summer Davos in Tianjin, Li also said the flexibility of the yuan's exchange rate has increased and China will adjust its currency value according to its own needs.

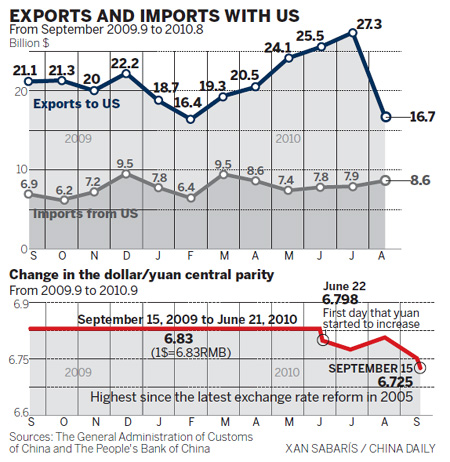

China accelerated the foreign exchange rate reform in June to allow more yuan flexibility against a basket of currencies. During the past three months the yuan has risen 1.5 percent, and in the past four trading days it has gained 0.5 percent against the US dollar.

Yao said China's trade surplus with the US "only reflects part of the economic relations and the two economies are highly complementary to each other".

China is now the third largest export market for the US and during the first seven months of this year US exports to China surged by 36.2 percent year-on-year, 15 percentage points higher than that for its imports from China during the same period, the Ministry of Commerce said.

The US call for yuan revaluation will only bring them "political benefits, rather than create more jobs as promised", American economists and business groups have said.

The focus of the two-day hearings of the House Ways and Means Committee is to classify an undervalued currency as an illegal subsidy and thus allow protectionist measures against the supposed subsidy in the form of countervailing duties (CVD) or something similar. But, "this ostensible logic fails at every step", said Derek Scissors, an economist with the Asian Studies Center at The Heritage Foundation.

He said undervaluation is not a factor in the US trade deficit with China and there is very little evidence the yuan's exchange rate costs the US a large number of jobs.

"The immediate problem with such a proposal is that even the loudest proponents of CVD cannot determine the exact amount of undervaluation of the yuan and therefore cannot properly set the size of CVD in this case," Scissors said.

| |||||||

Linda Menghetti, vice-president of the Emergency Committee for American Trade, said she opposed the Congress committee's action on behalf of business leaders in the manufacturing, financial, processing, merchandising, and publishing sectors. Many US legislators are pushing for a vote on a China currency bill.

"Congress passing such legislation will turn the world's eyes to the US as a unilateralist in the picture and all the attention we are trying to get multilaterally on China will evaporate to some extent," she said.

"China is ...the only market on which we can depend to help us double exports," she said. "It (any legislation) will take the oxygen out of the US-China commercial relationship."

Tan Yingzi reported from Washington. Xin Zhiming in Beijing contributed to this story.