Companies

Gome spat stirs up challenges

By Bao Chang (China Daily)

Updated: 2010-09-20 09:59

|

Large Medium Small |

|

|

|

Two workers put up a promotional banner outside a Gome Electrical Appliance Holdings Ltd store in Shanghai. [Kevin Lee / Bloomberg] |

Gome spat stirs up challenges, highlighting overseas investment

BEIJING - A spat between an imprisoned billionaire and a senior business executive has spilled into the public arena, becoming a focus of nationalist sentiment and exposing the challenges of foreign investment in Chinese brands.

"My life is totally under threat and normal work has been seriously influenced," said Sun Yiding, vice-president of Gome Electronic Appliances Holdings. He claims he has been besieged by endless messages and phone calls from strangers calling on him to support Huang Guangyu.

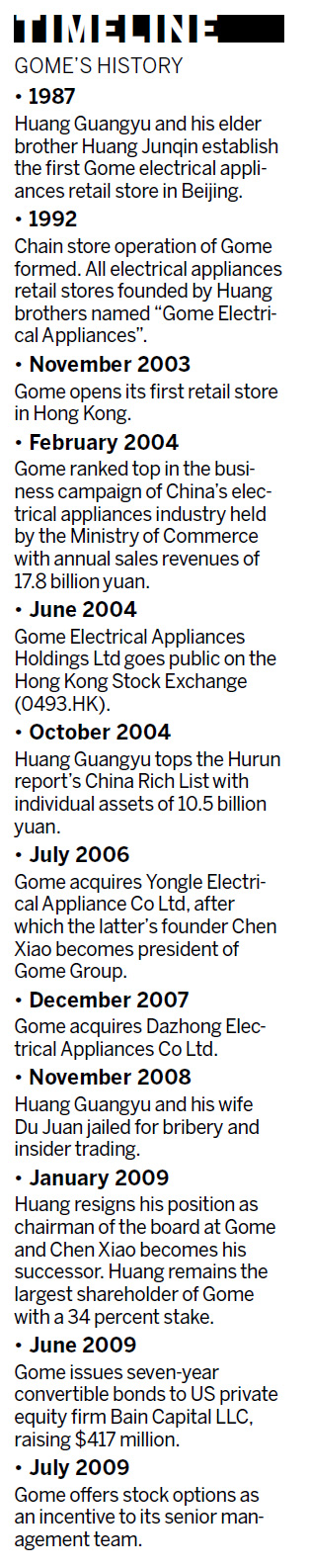

Huang,who is in prison, is the founder and remains the largest single shareholder of Gome with a stake of 32.47 percent in the company. Before being sentenced to a 14-year stretch for bribery, China's youngest self-made billionaire used to be regarded as an idol by many because of his pioneering spirit.

The power tussle between Huang and Gome's current chairman, Chen Xiao, has turned into a nationwide debate since it broke out last month.

Last month, Huang sought the removal of Chen and three directors appointed by US equity firm Bain Capital LLC, claiming that Gome's performance had deteriorated under Chen's leadership. Gome's management, including Sun, most of whom were promoted by Huang, announced they would stand by Chen.

Last week, Huang said he may seek to sell 400 privately owned stores to the company to increase his stake. He retained personal ownership of part of the appliance chain's network when it listed in Hong Kong in 2004. The sale would increase Gome's outlets by about half and boost Huang's stake in China's second-biggest electronics retailer. Huang, who resigned from the board and was sued by Gome after his detention for economic offenses, is seeking to oust Chairman Chen and force the company to scrap a plan to sell shares that might dilute his stake.

Huang was ranked the second-richest person in China in 2008 by Forbes Asia, with an estimated fortune of $2.7 billion. He topped the Hurun Report's China Rich List that year with an estimated net worth of $6.3 billion.

Suggestions that Gome is being "Americanized" have also been stirred up on the Internet, after Chen received support from Bain when the equity firm announced it would exercise an option to take a 9.98 percent stake in Gome and vote for Chen Xiao at an upcoming special shareholders' meeting.

However, industry experts believe that with global economic integration, what matters most to shareholders, management and foreign investors is the brand's market value, not its nationality.

Sang Baichuan, a professor at the School of International Trade and Economics at the University of International Business and Economics (UIBE), said: "If a company established and controlled by Chinese people has more enterprises abroad than at home, we can't say the company contributes a lot to its own country other than that it satisfies an element of nationalist sentiment."

Gu Zhengping, a lawyer at Zhong Lun Law Firm, said: "According to Gome's financial statements, Gome is developing well under the leadership of the current management and is at least bringing benefits to all shareholders."

|

||||

Gome and its rival Suning currently operate 1,141 (including Huang's 400 privately-owned stores) and 1,075 retail outlets respectively across the country, each controlling 8 percent of the market, according to Everbright Securities.

Sources close to Huang claimed that Gome would be overtaken by Suning within two years under Chen's management. A difference in opinion on the way the company should develop caused the dispute between Huang and his successor. Ye Tan, a financial commentator, said in a blog that without peaceful coexistence, the power feud within the company would continue so long as shareholders and management hold different opinions.

However, Sang from UIBE, said he believed that behind the dispute on Gome's strategy was a battle for control of the brand. He said owning a valuable brand was a guarantee of stable revenues, especially if it had a near monopoly.

"Chen, Huang and Bain Capital all have a claim on the governance of Gome and have the right to open chain stores both in domestic and foreign markets using the Gome brand and sharing in its good recognition," Sang said.

Sang added that Gome was a locomotive for China's retail business, so it was normal that each party was striving to gain control of the company. They realized the value of intangible assets such as the Gome brand, which was central to the value of the company.