Economy

Surplus to shrink more for rest of year

By Ding Qingfen (China Daily)

Updated: 2010-10-14 10:26

|

Large Medium Small |

Reduction will ease pressure for yuan appreciation, say economists

BEIJING - China's trade surplus will continue to shrink this year despite the fact that the September figure was the lowest since May, economists said.

The surplus reduction will ease pressure from the United States and the European Union on China to appreciate the yuan, they added.

The predicted fall in the surplus is due to China's increased demand for commodities and the rising cost of imports, they said.

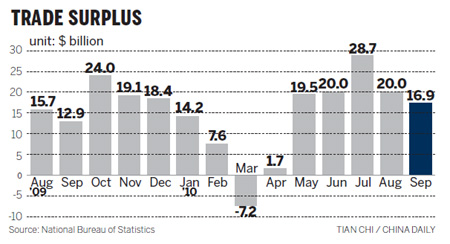

The General Administration of Customs announced on Wednesday that China's exports in September grew by 25.1 percent from a year earlier and imports climbed by 24.1 percent, leading to a monthly surplus of $16.88 billion.

The figure is the lowest since May, and well below this year's highest, $28.7 billion in July. Trade surplus in August was $20 billion.

"China's monthly trade surplus will gradually get smaller during the rest of the year, while the economy outperforms most nations and regions worldwide," said Zhu Baoliang, an economist with the State Information Center.

"China's sustained growth will boost imports, but external demand will decrease amid the slow recovery in developed economies."

China has been under intense international pressure over the past few months to allow its currency to rise, due in large part to a trade surplus that peaked in July and has remained above $16 billion since May.

US Treasury Secretary Timothy Geithner on Wednesday criticized China's currency policy and said it had caused global currency market interventions by some economies.

Jean-Claude Juncker, who chairs meetings of the 16-member euro zone's finance ministers, also said recently that the yuan is "more than undervalued".

But a declining surplus means that China probably will not face increasing pressure over its currency.

"I don't think the situation will get worse, although the pressure will be there for months", Zhu said.

China's surplus with the US fell to $18 billion in September, but the surplus with the EU climbed to $13.9 billion. Imports from the Association of Southeast Asian Nations accelerated, resulting in a deficit of $3.1 billion, the largest ever.

|

||||

Li Wei, economist from Standard Chartered Shanghai, said that the September trade figures "suggest moderations in both export and import growths in China, but the prospects of near-term export growth were more of a concern than imports".

A report by Citigroup Global Markets agreed. "Going forward, export growth should continue to moderate under a slower growing global economy and a more expensive renminbi. Imports, however, should outpace exports in the coming months. A narrowing surplus and the steadily appreciating yuan should alleviate risks of 'currency war'. "

China speeded up foreign exchange rate reform in June and the yuan has gained more than 2 percent since then.

The US will unveil a currency report on Friday and decide whether to label China a "currency manipulator".

The US Senate is also considering legislation to impose duties on Chinese imports because of what some senators consider China's unfair currency advantage.

But central bank governor Zhou Xiaochuan said recently that a fast appreciation of the yuan is not a panacea for global economic imbalances. Premier Wen Jiabao said in Europe earlier this month that nations must work together to keep exchange rates of major reserve currencies relatively stable.