Opinion

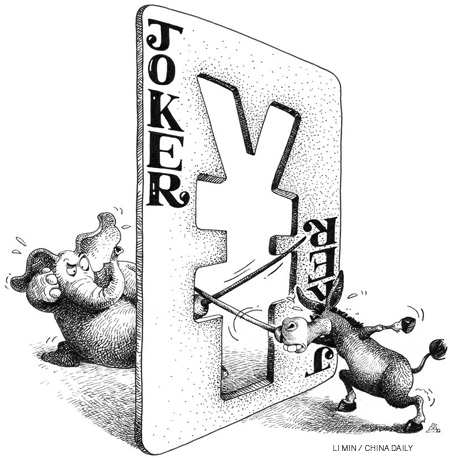

US' much ado about nothing over the yuan

By Mei Xinyu (China Daily)

Updated: 2010-11-03 14:04

|

Large Medium Small |

United States politicians have been accusing China of undervaluing its currency for some time now. Their desperation to win the midterm election (which was held on Tuesday) made them intensify their attack. The unnecessary hue and cry over the yuan has even created the fear of a currency war.

China has the largest foreign exchange reserve in the world, most of it in US Treasuries, which some experts say could make it fire the first salvo in the feared currency war.

Unfortunately, they don't consider US politicians' ranting as salvos. Perhaps, they think the US has the right to blame the yuan for the trade imbalance between China and the US. How about the passage of the proposed Currency Reform for Fair Trade Act by the US House of Representatives? Wasn't that a salvo, either? To be fair, the Senate has to pass the bill for it to really become an act.

The bill, once passed by the Senate would allow the US Department of Commerce to slap sanctions against trade partners that are deemed to be manipulating their currencies. And China happens to be on top of the list of such trade partners. So will the feared currency war become real?

There's a simple solution to all the currency-related problems that the US fusses about. Let the dollar cease to be the dominant world currency. But is the US ready to blaze such a trail?

The history of world politics and economy tells us what a hazard the bill, now with the Senate, is for the US, and even the world, economy. It wouldn't be an exaggeration to call it is a mix of the 1930 Smoot-Hawley Tariff Act, which raised US tariff on thousands of imported goods to record levels, and the 1934 American Silver Purchase Act, which inflated the price of the metal and destroyed China's currency system.

China is the world's largest exporter and one of the largest importers, and still has the fastest economic growth among the top trading nations. It has become an important link in the complex global production chain. And since it holds the largest share of the world's foreign exchange reserves, it injects a vigorous flow of capital into the world market.

The bill with the Senate acquires global implications similar to that of the 1930 US tariff act because of the formidable role that China plays in the world economy. To put it simply, if China and the US, the world's two largest trading powers, enter a full-blown trade and currency war, the global trading system will suffer greatly.