Fuel price mechanism

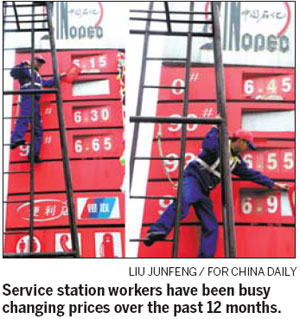

The central government raised both gasoline and diesel prices by 320 yuan per ton, or 4 to 5 percent, last week, pushing domestic fuel prices to new record highs. The increase will mean increases of 0.24 yuan per liter of gasoline and 0.27 yuan per liter of diesel at the pump.

It was the ninth domestic fuel price adjustment since last year, when regulators adjusted fuel prices eight times, including five hikes and three decreases.

China adopted a new fuel pricing mechanism in January last year, under which the National Development and Reform Commission, the country's top economic planner, will consider adjusting the benchmark retail prices of oil products when the international crude price changes more than 4 percent over 22 concurrent working days.

Electric mobility

China's privately owned battery and carmaker BYD, backed by Warren Buffett, signed an agreement with Daimler AG at the beginning of March to form a "comprehensive technology partnership" for the development of electric vehicles for the Chinese market.

According to the deal, the two companies intend to develop a new electric vehicle specific to the requirements of the Chinese market. The vehicle will be marketed under a new marque jointly created and owned by the Hong Kong-listed BYD and Daimler. A common technology center will be established in China to develop, design and test the electric vehicle.

The apparent aim of the two parties is building synergy between Daimler's know-how in electric vehicle architecture and BYD's excellence in battery technology and e-drive systems.

The deal followed another BYD agreement, with Volkswagen, in May last year to join forces in petrol-electric hybrid cars and lithium battery-powered electric cars.

The Chinese government backs the development of electric mobility with favorable policies and subsidies to promote widespread use of the vehicles across the nation. In addition, the government-owned giant State Grid and major oil suppliers are establishing a charging station network for electric vehicles.

GM changes JV stakes

US carmaker General Motors (GM) reduced its 50 percent stake in its passenger car joint venture with SAIC Motor Co Ltd in December as SAIC, China's top auto group listed in Shanghai, raised its share in Shanghai GM to 51 percent.

It an unprecedented move, as all other Sino-foreign passenger car joint ventures have a 50-50 equity structure. Past realignments have seen foreign carmakers raise their stake to 50 percent, the maximum allowed by the Chinese government.

GM said that the move would help SAIC consolidate Shanghai GM's revenue into the Shanghai-listed parent to provide investors with "a clear understanding of its business".

Shanghai GM is one of the biggest passenger car producers in China. Last year, it moved 727,000 cars.

GM is now seeking to increase its stake in a mini bus joint venture with SAIC and Wuling Motors, which is owned by the government of south China's Guangxi Zhuang autonomous region.

GM plans to increase its stake in the venture to 44.9 percent from the current 34 percent. SAIC's share will remain unchanged at 50.1 percent, while Wuling Motor's stake will decline from 15.9 percent to 5 percent. The joint venture is the top mini bus maker in China with record sales of more than 1 million units last year.

| Press Preview: April 23 - April 24 |

| Industry Preview: April 25 - April 26 |

| Public Show: April 27 - May 2 |

| Auto Components and Parts: April 23 - April 27 |

|

Venue for Passenger Cars and |

|

Venue for Auto Components and Parts: |

|

Gallery Guide: |

A Cadillac Converj concept car is displayed at Auto China 2010 in Beijing. Cadillac is one of GM Group's sub-brands.