US lawmakers renew bid to punish yuan

By Tan Yingzi (China Daily) Updated: 2011-02-11 13:38

WASHINGTON - A group of 101 United States lawmakers have re-launched an attempt to punish China into reforming its currency exchange rate.

On Thursday, a bipartisan group of lawmakers in the House of Representatives, led by Representatives Sander Levin, D-Mich; Tim Murphy, R-Pa; and Tim Ryan, D-Ohio, introduced the Currency Reform for Fair Trade Act of 2011. Senators Sherrod Brown, D-Ohio; and Olympia Snowe, R-Maine, introduced the bill in the Senate.

A similar bill was passed by a solid margin by the House last year but was defeated in the Senate. If it is passed through both houses of Congress, it will allow the Commerce Department to impose emergency taxes on China if its yuan currency is deemed undervalued.

The bill addresses concerns that China undervalues its currency by anywhere from 15 percent to 40 percent to give its companies a price advantage in international trade.

The lawmakers' action came after Federal Reserve Chairman Ben Bernanke and Treasury Secretary Timothy Geithner openly pressured Beijing this week to let the yuan rate rise, although last Friday the Treasury Department decided not to declare China a currency manipulator.

China's currency exchange rate has been a key and sensitive issue between China and the US in recent years. Washington blames Beijing for undervaluing its currency in order to promote exports and US legislators have said the rate has led to high unemployment and a significant bilateral trade deficit.

China has recently allowed more flexibility in the exchange rate. In the past few months, the yuan has appreciated 3.7 percent against the dollar. On a real inflation-adjusted basis, the appreciation was higher, rising at an annual rate of more than 10 percent, according to a recent US Treasury Department report.

The new US push will likely create more friction between Beijing and Washington this year although analysts from both China and the US initially expected the new House of Representatives, where Republicans hold a majority, to take a more subtle approach to China's exchange rate.

According to the Associated Press, the new Republican leadership said passing the new China currency bill is not a top priority this year.

President Hu Jintao said during his state visit to the US last month that China will continue to reform its exchange rate and maintain a gradual rise in the yuan despite US pressure.

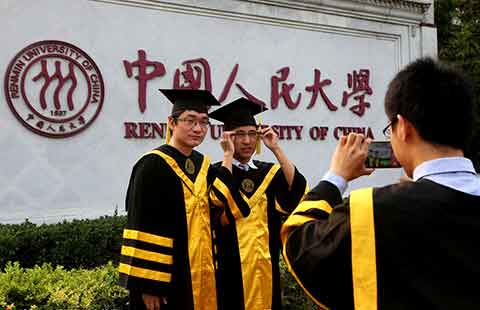

"Every country has a responsibility to maintain the stability of the international markets and assets," said Zhao Xijun, deputy director of the Institute of Finance and Securities at the Renmin University of China. "But what the US is doing now with quantitative easing does not show it cares about the effect on other countries."

On Thursday, China's Foreign Ministry spokesman Ma Zhaoxu said China will continue its policy of pushing to reform its exchange rate, but added the yuan's value is not the reason for the bilateral trade gap.

Several economists agree that the yuan's value is not the main cause for the China-US trade gap. The US' lack of manufacturing competitiveness, its move to block high-tech exports to China and its miscalculation of China's exports are likely the real factors in the gap, they said.

Internationally, the issue of currencies will likely dominate next week's meeting of the Group of 20 finance ministers and central bank governors in Paris.

China Daily

(China Daily 02/11/2011 page1)

- Novartis Shanghai R&D center to help meet nation's health needs

- China's love affair with soccer sees investors score

- China Mobile says its internet-of-things sales to hit $15b

- EU said to bolster antitrust probe of Google

- Fosun chairman says the company focuses on health, wealth and happiness

- Zeavion to buy early education business of America's Gymboree

- Midea reaches binding investment agreement with Kuka

- CITIC Bank and Uber to issue co-branded credit cards