Companies

Wenzhou firms seek new wealth ways

By Yu Ran (China Daily)

Updated: 2011-05-04 15:05

|

Large Medium Small |

Higher returns from property, stocks and commodities lure factory owners, reports Yu Ran in Shanghai.

Wenzhou seems to be undergoing a midlife crisis.

A secondary city in East China's Zhejiang province, it built a vibrant manufacturing base for a wide range of consumer goods - from shoes to ties, cigarette lighters to spectacles - over the past three decades, helping make China the world's workshop.

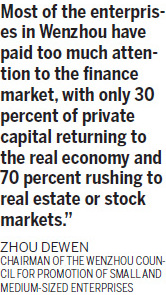

But labor is not as cheap as it was and inflation is squeezing profit margins. Many factory owners are chasing higher financial returns by investing their capital in property, stocks and commodities.

The birthplace of China's private economy, a producer of tangible goods, has become a hotbed of enterprising business people whose collective investments have moved the price of land and commodities in cities and towns around the country. And now some of those people are moving their operations out of the city.

What does that mean for Wenzhou? What does that mean for China?

Seventy people worked at the lighter factory when Chen was hired as a watchman in 2002. "I saw the number rise to a peak of 300 in 2007," he said. Since then, the factory has gone on a rapid decline, as fewer orders have come in from overseas or the domestic market. None of the remaining workers returned to work after the 2011 Chinese New Year break, Chen said.

As old lighter and eyeglass operations shut down, some other companies moved in and started making shoes or clothes.

"Normally the closing down and staying empty of a factory won't last over two months, and buyers will come along to speculate in the area and workshops, so the number of my customers won't decline," said Cai Qian, who owns a convenience store nearby.

At the latest count, Wenzhou had 240,000 privately owned commercial and industrial enterprises. Those numbers do not reflect the recent decrease in manufacturing.

With a GDP of more than 292 billion yuan last year, 11.1 percent higher than the previous year, the average annual income of Wenzhou residents exceeded 31,201 yuan ($4,807). The national average for urban residents last year was 21,033 yuan.

|

|

|

|

|

Gao Tianle, a 48-year-old entrepreneur, is chairman of Zhejiang Tengen Group, one of the largest industrial electrical equipment manufacturers in China. He dipped his toe into new waters in 2003 when he launched a property agency in Nanjing and an investment company in Shanghai.

"I started in 2001 putting money into equity investment to make use of extra money," Gao said.

With assets of 1.66 billion yuan, Tengen Group has headquarters in Shanghai; four factories and office buildings with research centers in Wenzhou, Shanghai, Nanjing and Jiaxing; a scientific research base in Silicon Valley in the United States; and 16 subsidiaries all over China.

It also has developed at least four luxurious neighborhoods in Nanjing, Jiangsu province, expanding its real estate investments to include interior design and property management. The company also bought enough shares in commercial banks to have some say in how they operate.

"I've never borrowed money for investment," Gao said. "It's essential to use only cash."

Gao said he might grab other investment opportunities but he is still keen to keep his company a leader in manufacturing industrial electrical facilities.

| 分享按钮 |