A taxing issue for online shops

Updated: 2011-07-12 09:27

By Yang Wanli and Chen Limin (China Daily)

|

|||||||||||

E-commerce may lose its competitive edge, report Yang Wanli and Chen Limin in Beijing.

It started a year ago, when China issued its first regulation targeting online trade and services. Then, last month, Wuhan city officials collected more than 4.3 million yuan ($665,000) in tax from a company that sells clothing online.

Rumors flourished: Is the government going to start taxing online sales? What does that mean to my business - or my shopping habits?

|

Many observers seem to have jumped the gun on the regulation, Wuhan tax collection and the rumored imminent introduction of e-commerce tax. But economic reasons make such a tax possible. It's happening in other countries.

As many as 161 million people, more than one-third of China'sInternet users, shopped online last year, according to the China Internet Network Information Center. Sales reached 523.1 billionyuan, more than double the total for 2009, and accounted for 3.3percent of all retail sales.

Deutsche Bank expects e-commerce will help drive retail sales to more than 1.5 trillion yuan, a 7.2 percent share of all domestic retail sales, by 2014.

|

The tax at issue is not a sales tax, although the effect on consumers is the same. It's a value-added tax (VAT), and the regulation has been around since Dec 5, 2008.

It says that all people and entities engaged in the sales of goods; in providing processing, repairs or replacement services; and in importing goods to China are subject to paying VAT.

"According to the regulation, most online shops should pay value-added tax," said Liu Tianyong, senior partner of HwuasonLaw Firm, the first in China to specialize in taxation law.

In Central China's Hubei province, the tax bill presented to Wuhan Zhuana Garment Co Ltd included VAT, enterprise income tax and an overdue fine for transaction volumes of 105 millionyuan last year, according to Zhou Guangchun, spokesman for the Wuhan Municipal Office of State Administration of Taxation.

He said the company sells clothes through both traditional sales channels and its store on Taobao, China's biggest online selling platform.

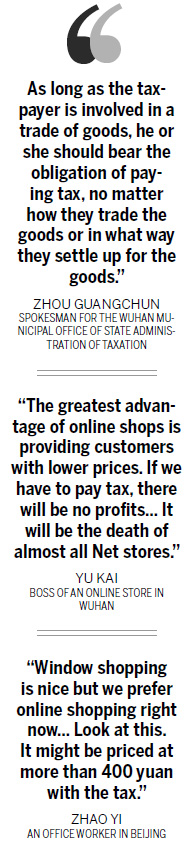

"As long as the taxpayer is involved in the trade of goods, he or she should bear the obligation of paying tax, no matter how they trade the goods or in what way they settle up for the goods," Zhou said.

85% 'no' votes

Sina Weibo, a popular Chinese language Twitter clone, asked users in late June: "Do you support the collection of tax on online stores?" As of Monday, more than 5,200 votes had been cast, 85 percent of them against the idea.

Most of those who commented said they worry that taxes would lead to higher prices online and that e-commerce would lose its competitive edge.

"My God, if tax is charged on Net shops, how can we survive? The only way out is to close the store," Heaven Lin posted on Wednesday.

About 7 percent of the votes supported tax collection on Net sales; remaining voters stated no preference. Tianjinwolf said tax should be collected because it would put the sellers under government supervision, better protecting customer rights.

Zhao Yi, 27, would fall into the "no" category. Shopping is how she and her female friends spend their spare time - and their money. Zhao earns 8,000 yuan a month as an office worker in Beijing, and about half of that supports her shopping habit.

"Window shopping is nice but we prefer online shopping right now," she said. And the idea of adding tax to her purchases? "It's awful!" Zhao had just brought a blue party dress on Taobaofor 328 yuan, less than she would have paid at a mall. "Look at this. It might be priced at more than 400 yuan with the tax," she said.