Zhejiang's SMEs quickening pace of stock listings

Updated: 2011-07-22 10:45

By Xu Junqian (China Daily)

|

|||||||||||

HANGZHOU - Private enterprises in Zhejiang province, especially small- and mid-sized enterprises (SMEs), are speeding up their migration to listed status, said Ernst & Young (E&Y), a leading global tax and transaction service provider.

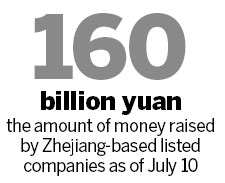

According to data released by E&Y on Thursday, there are 252 Zhejiang-based listed companies that have raised more than 160 billion yuan ($24.8 billion) on the capital markets as of July 10.

Thirty percent of those companies held an initial public offering (IPO) during 2010 and the first half of this year, and the pace of listings is likely to be sustained or even accelerate for the rest of this year.

"There is always a strong desire among Zhejiang's entrepreneurs to have their companies listed on the stock market," Terence Ho, greater China IPO leader, assurance of E&Y told China Daily.

"But with the relaxation of government regulations (for SMEs' listings), the number has increased dramatically in recent years, which, in return, encourages more and more SMEs to join the trend," Ho said.

|

The Shenzhen exchange was the first choice among these enterprises, having attracted 132 IPOs, with 99 on the SME board.

As to industry, manufacturing and retail continue to dominate new listings. Despite an increase in IPOs by high-tech or e-commerce companies, the dominance of older industries won't soon be reversed, as in most parts of Zhejiang, especially the South, manufacturing is still the staple industry.

"It's like getting a master's or doctoral degree for a graduate student looking for a job," said Dong Xuekui, an entrepreneur from Jiaxing, Zhejiang, who plans to list his 12-year-old construction contracting company next year.

"It can mean more capital, more talent, a better reputation and higher competitiveness against peer companies when bidding for a project," said Dong.

He said an IPO would be a key step in the expansion of his company, which had gross revenue of 1.5 billion yuan in 2010 and has been growing 20 percent to 30 percent annually.

E&Y said the top problems facing Zhejiang companies wanting to list are questions about their financial practices.

For example, said Ho, when a company owner ("the boss") wants to buy a car or an apartment, he just uses the company's funds. But Ho added that the companies in Zhejiang are still the ones that E&Y is least worried about, compared with those from other cities.

Entrepreneurs from Zhejiang usually have many good qualities, Ho said, including initiative, innovation, strategic thinking and personal integrity, which may have helped them in the business world and the IPO market.

In the first half of 2011, the Chinese IPO market remained robust, sustaining its global leadership in terms of the number of new listings and funds raised.

Ho forecast that China's IPO market will remain strong, since listed companies still account for a very small proportion of the total in the world's second-largest economy, compared with the United States.

Private enterprises in places like Zhejiang will be the main driving force in the IPO market, Ho said.