Trade surplus shrinks as imports post surge

Updated: 2011-11-11 09:20

By Diao Ying and Ding Qingfen (China Daily)

|

|||||||||||

|

Workers make underwear for export to Japan at a factory in Qingdao on Wednesday. Exports increased 15.9 percent to $157.49 billion in October, the lowest level for five months. [Photo/ China Daily] |

Shipments to Europe grow more slowly; curtailed by debt, uncertainty

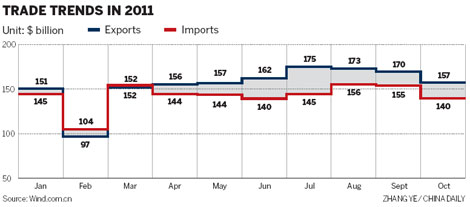

BEIJING - China's trade surplus narrowed in October as unexpectedly strong domestic demand lifted imports and weak US and European demand curbed export growth, official data released on Thursday show.

Imports surged 28.7 percent year-on-year to $140.46 billion, the General Administration of Customs said on its website on Thursday.

Exports increased 15.9 percent to $157.49 billion, the lowest in five months, the data show.

The result was a trade surplus of $17.3 billion, down 36.5 percent year-on-year.

"The nearly 29 percent import increase caught us by surprise," said Hu Yanni, a macroeconomist at China Securities Co Ltd. "The data show that domestic demand remains pretty good. Investment needs in China are better than expected," Hu said in a telephone interview.

For the first 10 months, China imported 560 million tons of iron ore, up 10.9 percent, the customs statement said. Imports of machinery and electric products increased 15.6 percent to $619.9 billion, while vehicle imports were up 27.6 percent to 820,000, according to the data.

"The strong import growth shows that domestic demand remains strong," Zhang Zhiwei, an analyst with Nomura Securities, said in an e-mailed report. "Robust domestic demand will help to support the soft landing of China's economy," he said.

The government has more room to increase domestic demand, Hu said. Infrastructure construction in the western part of the country and investment in agriculture have the potential to further improve import demand, she said.

The import surge also reflects the impact of government policies, analysts said. The government has been encouraging an increase in imports to achieve a better trade balance. It is formulating policies such as credit for importers and lower import tariffs, Premier Wen Jiabao has said.

Imports will exceed $1.7 trillion in 2011 and total imports will amount to about $10 trillion over the next five years, Commerce Minister Chen Deming wrote recently.

But the outlook for exports is less positive. Analysts said that the pace of export growth would keep sliding next year as Europe, China's largest foreign market, remained mired in a debt crisis, while the outlook for the US, the second-largest market, was uncertain.

"Weak external demand will restrain exports," said Zhang.

"Europe is China's largest market, and it has not shown any positive signs of improvement," said Hu. Shipment growth to the European Union slowed to 7.5 percent in October, compared with a 9.8 percent increase in September, customs data show.

The Canton Fair, known as the barometer of China's trade, has also seen a decline in overseas orders.

During the most recent session, which ended early this month, US orders were down 24 percent from last year and orders from Europe fell 19 percent, according to organizers of the event.

Weakening external demand is causing hard times for small and medium-sized enterprises (SMEs) in southeast China, the country's main export hub.

"This is a tough time for SMEs," said Chen Yongfang, a trade official in Guangzhou, capital of Guangdong province. "It has become pressing for these companies to transform themselves," he said.

Some small companies, boxed in by a stronger yuan and rising labor costs, may have to close, according to Zhang Yujing, president of the China Chamber of Commerce for Import & Export of Machinery & Electronic Products. "This is a wake-up call for the survivors to modernize," he said.

"Many small-scale businesses will die because they have been competing on low prices instead of advanced technology," said Chen Hanhui, vice-director of Tech-Long Packaging Machinery Co Ltd, China's leading packaging machinery manufacturer whose clients include Procter & Gamble Co and Coca-Cola Co.

"The industry needs to invest more in technology development and human resources," he said.