Chinese wine investors worry as rare vintages drop in value

Updated: 2012-02-03 10:17

By Tang Zhihao (China Daily)

|

|||||||||||

SHANGHAI - Tipsy Chinese investors drunk on the legend of Lafite wine have been rudely shocked by the cold economic fact that what goes up can come down.

|

|

|

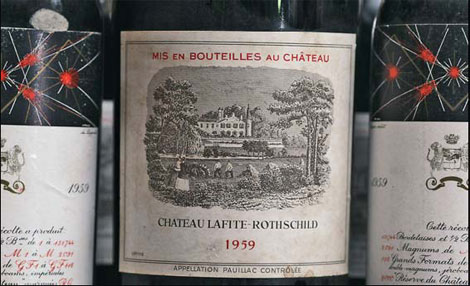

A bottle of Chateau Lafite 1969. The Liv-ex Fine Wine 50, a benchmark index that tracks daily prices of the most heavily traded wine, dropped by some 16.6 percent in 2011.[Photo/China Daily] |

Helping to push the prices of branded wine up by an average of 30 percent in each of the past several years, Chinese investors in Guangdong, Zhejiang, Shanghai and Beijing were dismayed to find that their cherished investments lost as much as 40 percent of their value within a few months.

Wine merchants in Shanghai and Hong Kong attributed the setback to the global economic slump.

Despite the sharp reverse, investors have largely remained sanguine.

"The price of red wine rose over the past decade. I think it is normal to have some fluctuations in the wine market," said Zhou Yang, a wine collector from Yiwu in Zhejiang province. "But I believe the price will not go into a free fall because vintage wine has remained one of the best hedges against inflation."

Zhou said he would spend more than 100,000 yuan ($15,857) on red wine every year, some of which he drank.

Wang Jiaqi, business development director of Shanghai International Wine Exchange", said the fall in prices in the Chinese market is in tandem with the international trend.

The Liv-ex Fine Wine 50, a benchmark index introduced by London-based Liv-ex Fine Wine Exchange to track daily prices of the most heavily traded wine, dropped by some 16.6 percent in 2011.

The prices of some famous branded red wine with high brand awareness among Chinese investors experienced a significant drop in 2011. For instance, a bottle of Chateau Lafite Rothschild 2008 is now priced at some 9,500 yuan, down from 15,000 yuan in early 2009.

A bottle of Carruades de Lafite is traded at 2,600 yuan to 2,800 yuan in the market, down by about 35 percent from its height in May 2011.

"The sovereign debt crisis in Europe did have an impact on wine prices. The fall in the trading price in overseas markets and the fluctuation in foreign exchange markets contributed to the decline," said Wang. "The change in macro policies in the Chinese market also had an impact on the wine trading market."

Wang said some people gambled on certain branded red wine but as investors become more knowledgeable it is reasonable to see prices adjusting to more normal levels, which is another factor contributing to the decline.

The wine trading market boomed in past decades in China, helped by the increase in business banquets and people's desire for a more luxurious lifestyle.

Figures from A.T. Kearney (ATK), a consulting company in the United States, suggest that revenue generated from wine sales in China reached about 53 billion yuan in 2009, benefiting from increasing wine awareness and rising health consciousness.

ATK pointed out that growth in both volume and value has been 15 percent or better on an annual basis over the past few years.

Related Stories

Women winemakers still battle glass ceiling 2011-08-20 07:53

A burst of fruit that is enhanced by quality oak 2011-07-24 11:01

'Best of the best' that gives joy when young and aged 2011-06-27 13:35

Biodynamic cultivation yields rich pickings 2011-01-17 13:47

- China's Jan non-manufacturing PMI drops to 52.9%

- CSRC to open securities to pension funds

- New iPhone sales begin on mainland with website

- Chinese bailout funding for Europe possible

- Travelers get urge to splurge

- New rules to restrict foreigners' ownership of homes

- Facebook IPO likely to boost China's SNS

- Slowdown but no hard landing in '12