Stock buyers pin their hopes on conferences

Updated: 2012-02-24 13:29

By Chen Jia (China Daily)

|

|||||||||||

|

|

A wide range of issues - including how to improve the capital market - is expected to be discussed during this year's sessions of the National People's Congress and the Chinese People's Political Consultative Conference, which will start in the first week of March.

Investors in the stock market want to hear effective policy suggestions from the legislators and advisers to protect their interests, after suffering serious losses last year, analysts said.

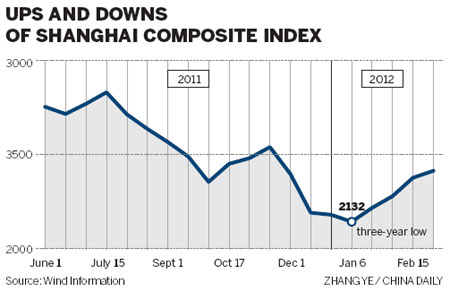

The Shanghai Composite Index, which tracks China's biggest stock exchange, declined by more than 21 percent to 2199.43 last year. It was the third-largest drop in its history, following a 65 percent nosedive in 2008 and a 22.3 percent plunge in 1994.

On average, stock investors lost about 40,000 yuan ($6,350) last year, their worst experience in the post-financial-crisis era, according to a report from the National Bureau of Statistics.

"Top officials are designing long-term stimulation policies to stabilize the stock market, as its performance is related to millions of investors' profits," said Li Daokui, a policy adviser to China's central bank and director of the Center for China in the World Economy at Tsinghua University.

Investors expect top authorities will discuss whether big institutional investors, such as the National Council for Social Security Fund, will inject money into the gloomy market soon to support share prices.

Guo Shuqing, the recently appointed chairman of China Securities Regulatory Commission, has in the past three months repeatedly urged social security funds to invest in the stock market.

"It is hard to preserve or increase the value of these funds without stock and bond markets after reviewing the experiences of developed countries, such as the United States and Japan," Guo said last week.

Zheng Bingwen, head of the Global Pension Fund Research Center of the Chinese Academy of Social Sciences, applauded the proposal of the watchdog's chairman.

"The sooner social security funds are put into the securities market, the less value depreciation we will have," Zheng said.

However, the previous big fluctuations in China's share prices and the recent grim situation, as well as the immature regulation system, sparked economists' worries about the safety of the large funds.

The main reason for the dim stock performance is not because of the shortage of funds, but is related to the unreasonable capital market mechanism and the lack of investor education, said Wu Xiaoqiu, director of the Financial and Securities Institute at Beijing-based Renmin University of China.

Contrasting with the bitter experience most ordinary share investors had, 277 companies went public in 2011 and raked in huge sums, raising 256.4 billion yuan, according to Wind Information, a Chinese financial information provider.

The government's encouraging policies boosted a large group of new listed companies in recent years, making China the world's largest IPO market since 2007. This magic "capital pool" was creating millionaires every month thanks to the extremely high IPO prices, while most private players lost their money in speculative investments.

"The Chinese stock market should shift its key role from raising money for companies to adding value for investors," Wu said.

To inspire investors, the outspoken watchdog chief Guo, a graduate of the University of Oxford, has outlined the direction of his reforms many times since he took office on Oct 30.

He required newly listed companies to specify dividend distribution rules in the share prospectus and urged regulators to improve the IPO verification system - though share prices have not immediately reacted to his blueprint.

More regulatory measures to protect investors' interests await discussion during the two sessions, including the reforms for the IPO issuing system, dividends distribution method and delisting procedure, said Wang Jun, a senior economist with China Center for International Economic Exchanges, a government think tank.

"The regulatory agency should look for solutions to the root of the problem," Wang said. "Market-oriented reform needs to be accelerated."

Related Stories

Stock investors in Jilin 2007-01-26 10:40

Stocks fall amid warnings to investors 2007-05-16 15:58

Regulators attempt to soothe stock investors 2005-08-26 11:30

New fund investors outnumber stock investors 2007-08-01 16:34

- Firms get approval to sell mutual funds

- China sets up first renewable-energy think tank

- Countries unite to tackle EU flight tax

- YOU On Demand signs deal to gain Disney's library

- Shanghai court postpones iPad decision

- Jordan faces challenge in a new court from Qiaodan

- Reform of VAT system may be extended

- Shortages of electricity set to persist this year