Insurance at a premium as firms face risks alone

By Xie Yu (China Daily) Updated: 2012-03-07 08:03

|

An injured Chinese worker is treated in Brazzaville, the capital of the Republic of Congo. At least 180 people, including five Chinese citizens, were killed in an arms depot blast on Sunday, the Congo's health minister announced on Tuesday after visiting hospitals. [Wang Minjie / Xinhua] |

|

|

A Chinese worker at a construction site in Khartoum, capital of Sudan, on Feb 2. More Chinese companies are expanding their businesses abroad but struggle to get insurance. Applications for projects in high-risk zones such as in Iraq or Sudan are routinely rejected by insurance firms, leaving companies to cover the costs in the event of accidents. [Ashraf Shazly / AFP] |

|

|

Liu Bingyun arrives at Beijing Capital International Airport on Feb 9 after he and another 28 Chinese workers were rescued from the hands of anti-government rebels in Sudan in late January. Liu's left foot was injured when the group was abducted. [Cui Meng / China Daily] |

Companies operating overseas have to deal with more than just business matters, Xie Yu reports in Shanghai.

After four years of running a company in Mozambique, Chen Songzeng has no doubt about who his most valued employees are: His seven fierce dogs.

"Dogs frighten thieves away; they're far more useful than security guards," said the boss of Jiangsu Water Resources Corp. He backed up his claim by adding that another Chinese company discovered its locally hired guards were actually assisting burglars.

After experiencing several raids on his offices, including by armed gunmen who took cash, computers and cell phones, Chen knows he can rely on no one but himself to protect his business - especially as he has no insurance.

"Chinese firms are unwilling to insure us. They think it's dangerous here, and it's also difficult for them to value property," he said. "The Chinese embassy sends us regular alerts and we hire loc

al security, but bad things still happen."

Chen's problem is all too common, and experts warn that the lack of insurance services for dom

estic firms expanding into developing regions, such as southeast Africa, is adding to the risk of overseas trade and investment.

Wei Jianguo, secretary-general of the China Center for International Economic Exchanges, explained that insurers have simply not kept pace with the corporations branching out abroad.

"Chinese companies suffered great losses when they withdrew from Libya (during its civil war last year). That sounded an alarm for us," the former deputy commerce minister said at a recent forum in

Shanghai. "However, the problem still exists, and the situation is even worse today."

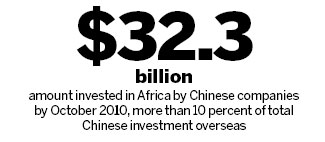

Ministry of Commerce data for May show that 13 State-run enterprises had been contracted for 50 projects worth a total of $18.8 billion. However, just 5.6 percent of these projects covering infrastru

cture, telecommunications, real estate and petroleum were insured.

Meager payouts

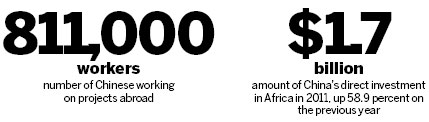

Commerce Ministry spokesman Shen Danyang said that by the end of last year, more than 18,000 companies had operations overseas, employing 1.2 million Chinese and holding assets worth a combined $1.5 trillion.

Very few have any insurance for their people or property.

"It is not that we don't want insurance, the problem is Chinese insurance firms are not willing to handle our business," said Zang Xiaojing, human resources manager at Shanghai Construction Group.

The State-run enterprise began taking on overseas projects in 1965 and today has roughly 5,000 workers on 10 construction sites worldwide.

"For those people working on national assistance projects, there is a compulsory life insurance that should be bought for them. The payout is only 50,000 yuan ($8,000) per person," Zang said. "That means if an accident happens, the company will cover the majority of the compensation."

Getting insurance for fixed assets overseas or international contract projects, which account for up for 80 percent of Shanghai Construction Group's business, is even harder.

"The tsunami in the Indian Ocean washed away all the equipment at one of our construction sites the diplomatic building in the Maldives. We could do nothing but put it down to bad luck," the HR manager added.

Avoiding the market

China Life Insurance, the country's largest State-owned insurance group, offers only one package for enterprises with workers abroad. It will cover groups of no fewer than 50 people and the payout sum is 200,000 yuan per person.

However, applications for projects in high-risk zones such as in Iraq or Sudan are routinely rejected. The same goes for China Pacific Insurance.

It is an "unwritten rule" that insurance companies do not offer life coverage for individuals in "dangerous, unstable regions or war zones", said Yi Si, a senior account manager at New China Life Insurance, a share-holding firm.

"Profits of insurance companies depend on probability. By evaluating quantitative data, we make sure we can make money," she said, explaining that there is no reliable analysis for employees on overseas projects.

"Meanwhile, the domestic market is already too large for us to fully develop. Why would we take the risk (on workers abroad)?"

It is even harder to get property overseas insured, Yi added, because it is difficult for underwriters to judge the value.

"The problem is there's no reliable organization in China that can support insurance companies to analyze the risks in different regions," said Wei at the China Center for International Economic Exchanges. "So instead, they choose simply not to enter the market."

The central government encourages State-owned enterprises with operations abroad to set up a service center that will offer plans for life, property and investment insurance.

In the meantime, as insurance firms are unwilling to handle the overseas expansion, he said authorities should encourage enterprises to get employees and assets covered by foreign insurers.

Yet, it is not a popular solution. Many Chinese bosses have raised concerns about communication, especially when it comes to submitting claims.

"We would still choose a domestic insurance company, even if it charged a much higher premium (than a foreign firm)," HR manager Zang said. "If they don't provide certain packages, then we'll just have to bear the risk ourselves."

Early warnings

When Cambodia was hit by flooding last year, a road that was under construction by Shanghai Construction Group was washed away, costing the company $2 million.

As the project was insured, most of the loss will likely be covered.

However, after several years of dealing with insurance brokers, Li Sen, who works in the company's contracts office, said he knows things are not always so easy.

"It's far more important for companies to strengthen their ability to avoid risks and deal with emergencies," he said, adding that insurance premiums can increase sharply after claims.

As a proactive step, Shanghai Construction Group has drawn up an emergency plan for its overseas operations. In it, managers are encouraged to establish close relationships with Chinese embassy officials and local authorities to ensure warnings and assistance in times of trouble.

The impression given by foreign media is that Chinese enterprises are striking deals around the world to ensure supplies of oil and other raw materials, often in areas passed over by Western companies. Yet, experts say investing in underdeveloped or "dangerous" regions is more down to market conditions.

"We have no choice," Liu Guijin, a special African affairs representative for China, said at a meeting with entrepreneurs in Shanghai in February. "Our companies want to develop in the global market, but mature and stable areas are already occupied by (companies in) developed countries."

Li Sen added: "Most of our projects are in less developed areas. We're not strong enough to compete (in the overseas market) with competitors from the US and Europe."

Shanghai's Dongfang Daily recently reported that, due to the risks, Chinese security firms are setting up offices in places such as Iraq. Embassies are also working hard to provide early warning to companies operating in unstable areas.

As of February, the Ministry of Commerce had issued 20 alerts this year to Chinese companies in West Asia, Africa and Europe.

Chinese workers were targeted twice in Africa in late January. First in Sudan, where anti-government rebels abducted 29 employees of Sinohydro Corp, and then in Egypt, where tribesmen took 25 more hostage.

In both cases, the victims were freed with help from local armed forces. However, one of the workers was killed during the rescue mission in Sudan's South Kordofan state.

"They (the workers who survived) were lucky, as China has good relationships with Sudan and Egypt," Zang said. "What can we do if similar things happen in countries that are less friendly to China?"

Huang Zhiling in Chengdu contributed to this story.

You may contact the writer through xieyu@chinadaily.com.cn

- SOE reforms to speed up, target five sectors

- Govt to invest $422b in railways over five years

- China June inflation forecast at 1.9%

- US hardwood exports to China rise

- Suning officially announces takeover of Inter Milan

- China's investment fund industry to continue expanding: report

- More Chinese companies ascend global arena

- China upgrades plan to boost rail network