Wanda's AMC deal a ticket to global role

By Huang Ying in Beijing and Liu Wei in Shenzhen (China Daily) Updated: 2012-05-22 09:02

Filmgoers at a Beijing theater run by Dalian Wanda Group Co on Monday. The Chinese conglomerate said it will buy US cinema chain AMC Entertainment Holdings for $2.6 billion to form the world's biggest movie theater operator. [Photo / Agencies]

Transaction marks largest overseas cultural investment by private firm

Dalian Wanda Group Corp Ltd, the owner of China's largest movie theater chain by box office receipts, acquired the world's second-largest theater chain - AMC Entertainment Holdings Inc - for $2.6 billion on Monday.

Under the terms of the deal, Wanda must assume the debt of the US cinema chain.

It also promised to invest up to $500 million in AMC to pay for its strategic and operating initiatives in the future.

The transaction marked the largest overseas cultural investment of a domestic private enterprise and it also strengthened Wanda's global status as an owner of movie theater chains.

"Wanda has been the largest theater owner in the second-largest film market in the world. Now, the deal makes it also the owner of the second-largest theater chain in the largest film market," said Chen Zheng, manager of Saga Cinema in Beijing.

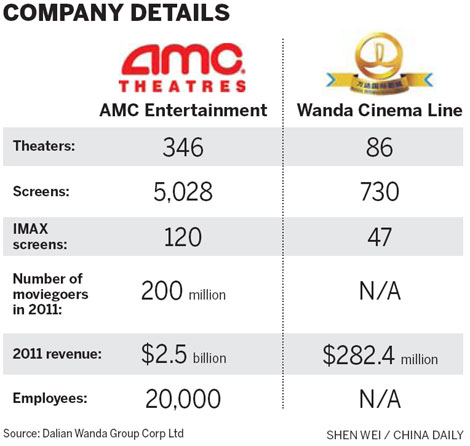

Wanda Cinema Line owns 86 cineplexes and 730 screens, of which 47 are IMAX screens, and it plans to increase its chain to more than 200 cineplexes with 2,000 screens by 2015.

Statistics from the State Administration of Radio, Film and Television show that Wanda Cinema Line generated 1.785 billion yuan ($282.4 million) in box office revenue in 2011, ranking first domestically. Total ticket sales reached 13.12 billion yuan that year.

AMC operates 346 multiplex theaters with 5,028 movie screens. As the world's largest operator of IMAX and 3D screens, it owns 120 IMAX screens and 2,170 3D screens, according to the official statement co-released by Wanda Group and AMC.

"We chose to acquire AMC mainly because of its potential value and the locations of its cinemas," said Wang Jianlin, chairman of Dalian Wanda Group.

Wang was ranked as China's sixth-richest person last year, having a personal fortune of $7.1 billion, according to the independent Hurun Report.

Wang said the purchase would turn Wanda into a "truly global" cinema owner.

Most AMC theaters are in downtown areas in the North America, and among the 50 highest-grossing cinemas in the market, 23 are from AMC, including six of the top 10.

Combined box office receipts for the United States and Canada reached $10.2 billion last year, according to the Motion Picture Association of America, although the audience is shrinking as people turn to the Internet.

Wanda's move followed News Corp's acquisition of a 19.9-percent stake in Bona Film Group Ltd, one of China's largest film distributors, which was listed on Nasdaq in 2010.

Both of these deals are seen as evidence of the two private companies' race for a license to distribute foreign films in the second-largest film market.

Wang said Wanda has applied for the license, but it's up to the authorities to decide whether this deal will increase Wanda's chance of winning it.

"However, it will be a trend for more foreign movies to come into China's theaters," Wang said.

The deal excludes film distribution activities, and none of the contracts the two parties signed mention the issue of promoting Chinese films in the US market, Wang said.

"The cold reception Chinese films encountered abroad is not simply due to the poor distribution channels, but its poor quality fundamentally," he added.

AMC will keep its original management team and employees.

AMC's headquarters will remain in Kansas City, Missouri, the statement said. The firm has a handful of theaters in Asia, including in Hong Kong and Japan.

As for equity structure, Gerry Lopez, chief executive officer of AMC Entertainment Holdings Inc, said "it will be unchanged".

"The only thing that changed is the boss," said Wang.

As for the factors leading to the acquisition, Ben Ji, an insider with 20 years of experience in the film industry, said it involved China's booming film market and the relatively slow growth in box office receipts in the North America.

Ben, who has worked in Hollywood studios and currently runs his own production company in China, said "the last few years have been difficult for theater operators in the North America, while the attendance at theaters has fallen to the lowest point in 16 years".

Wang said Wanda will continue to seek opportunities for overseas investments and mergers and acquisitions, especially in the cultural industry, having the goal of taking up 20 percent of the global film market by 2020.

AFP contributed to this story.

Contact the writers at huangying@chinadaily.com.cn and liuw@chinadaily.com.cn

- Money follows flow of outbound travel

- Internet platforms to ease woes of steel sector

- There's scary message for China bulls in financial firms' issues

- Nation's ODI in S. Korea surging

- Inventor makes good surface impression

- Toilet seat makers eye domestic market

- Germany 'key target' for Chinese IT firms

- Growing roots along the Silk Road