Policy pressure drops with price cuts

By Lan Lan and Zhou Yan (China Daily) Updated: 2012-07-11 09:16

|

|

|

A driver pays after refilling his vehicle at a gasoline station in Nantong, Jiangsu province, on July 9. China cut gasoline prices by 420 yuan ($66) a metric ton starting on July 11. [Photo / China Daily] |

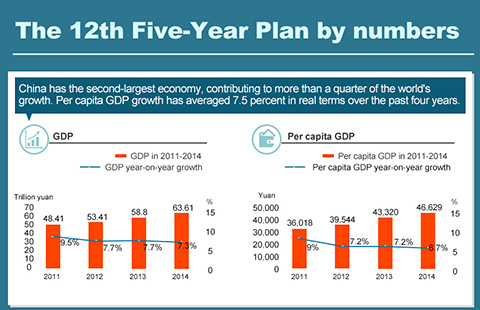

Retail gasoline price drops under 7 yuan per liter in most cities

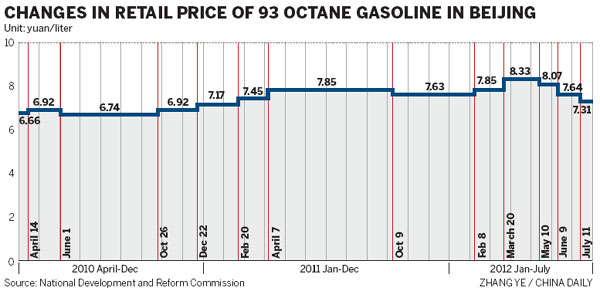

With gasoline and diesel-fuel prices falling for a third time since May on Wednesday, pressure on policymakers to revise the fuel-pricing mechanism has eased, as has the country's pressure from inflation, said analysts.

China cut gasoline prices by 420 yuan ($66) per metric ton and diesel by 400 yuan starting from Wednesday. The retail gasoline price drops to lower than 7 yuan per liter in most cities after the latest round of cutting.

This is the third consecutive cut since May, but a fourth one is unlikely unless the international market tumbles sharply, said Niu Li, a senior economist with the State Information Center, a government think tank.

China's gasoline and diesel prices are set by the National Development and Reform Commission, the nation's top economic planning agency, under a mechanism that tracks the 22-day moving average of a basket of crudes comprising Brent, Dubai and Cinta.

The NDRC has earlier implied it would reform the fuel-pricing mechanism by shortening the pricing time and increasing transparency. Industry insiders said a reform proposal has been submitted to the State Council, but has yet to be approved.

However, with global prices falling, analysts and officials have lowered expectations of short-term reform.

"The existing formula will be strictly followed at this stage," said a NDRC official, who declined to be named.

"The existing pricing mechanism will continue to work as the declining global crude oil price has reduced the urgency of shortening the pricing time," said Niu.

Zhou Wangjun, deputy director of the NDRC's price department, said the existing mechanism works "relatively successfully", but it needs to be improved in reducing pricing time and range.

The nation is waiting for an "appropriate time" to revise its fuel-pricing mechanism when international oil prices reach a relatively reasonable level, Zhou said.

Before that, the fuel rates will continue to be adjusted when the moving average of the basket of reference crude prices rises or falls more than 4 percent.

That moving average price of the Brent, Dubai and Cinta basket dropped by 9.57 percent between June 7 and July 9, according to JYD Online Co Ltd, a bulk commodity consultant based in Beijing.

Meanwhile, the lower fuel prices will continue to reduce the nation's inflation pressure.

China's consumer price index, a main gauge of inflation, had eased for four consecutive months in June, with growth slowing to 2.2 percent from a year earlier, the lowest in 29 months.

Han Jingyuan, an energy analyst with JYD Online, said a 10-percent cut in oil prices usually leads to 0.1 percent decrease in CPI.

The fuel price cut will erode margins at the nation's biggest refiners, such as China Petroleum & Chemical Corp and PetroChina Co.

Both companies reported crude-processing losses in the first quarter.

However, it will lower costs of major energy-consuming industries such as transportation, automobile, aviation and petrochemicals, and pass on the influence to consumer inflation eventually, the JYD analyst said.

Contact the writers at lanlan@chinadaily.com.cn and zhouyan@chinadaily.com.cn

- Chinese outbound real estate investment to reach $20 billion in 2015

- Pension funds ready to enter stock market in 2016

- China-Singapore Suzhou Industrial Park targets new reforms

- China's Belt and Road Initiative offers unprecedented chances in Asia

- Yuan usage in S. Korea's trade settlement hits record high in Q3

- ZTE launches new smartphone in Canada

- Beijing relaxes foreign investment rules

- 10 replicas of foreign sites in China