Iron ore stocks hit record high

By Du Juan (China Daily) Updated: 2012-07-20 09:36

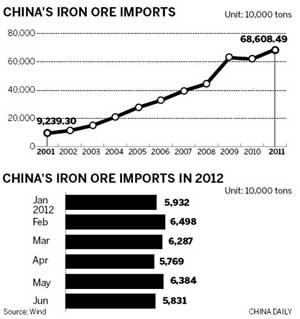

As the largest iron ore importer in the world, 60 percent of China's consumption depends on imports. Brazil exports up to half of its iron ore production to the Chinese market. Last year, Brazil's iron ore exports to China increased 7.8 percent, while its exports to Europe decreased 20 percent.

Although the increasing iron ore output in the international market indicates foreign miners' confidence in China's economy, prices will not rebound, analysts said.

According to a report by LCA Consultancy, the international average iron ore price dropped 16 percent compared with last year to $140 a ton. However, it is still much higher than the $80 a ton registered in 2009.

The consultancy said the decline of iron ore prices is closely related to China's economy. The country's growth rate has dropped from an average of 10 percent in past years to 7 percent or 8 percent this year, which will influence iron ore demand and prices in the international market.

Iron ore prices passed $100 a ton in March 2010 and kept increasing to $175 in September 2011. However, because of the severe oversupply in the market in the fourth quarter of 2011 and also due to China's macro policies on the real estate industry, both the iron ore and steel markets have seen a declining trend since then.

Most listed steel companies in China reported losses for the first half of the year and some of them have lowered both their steel product prices and sales targets this year.

Wuhan Iron and Steel Group Co, one of the major steel producers in China, cut its full-year profit goal from 3 billion yuan to 1.6 billion yuan on Wednesday.

Deng Qilin, general manager of the company, said they made the adjustment looking at the expected factors in the second half of the year.

The company had revenues of 98.9 billion yuan and profits of 1.38 billion yuan in the first half.

dujuan@chinadaily.com.cn

- S.Korea sees opportunity to expand presence in Chinese market with FTA

- Thailand-China railway cooperation a boon for both

- Mexico seeks to attract more Chinese travelers

- Hao Jianming: Business strategy with the wave of M&As

- Jack Ma shares spotlight with leaders and stars

- China's first electricity-powered aircraft gets production approval

- Yuan-denominated payment between China and Japan doubles: SWIFT

- Chinese firm to expand Kenyan airport