Homeward bound? Firms mull return

By Shen Jingting, Chen Limin and Tuo Yannan (China Daily) Updated: 2012-07-23 09:28Andrew Liveris, chairman and chief executive officer of Dow, one of the biggest manufacturing companies in the US, said in a speech at Michigan State University last year that innovation follows manufacturing closely and, without production, the US will gradually lose its source of innovation.

"Why should it matter that my iPad says 'built in China' when it also says 'designed in California'?" asked Liveris. If you outsource it, other countries start making devices, build research and development centers and universities around that industry to generate the human and intellectual capital to sustain it, upgrade it and then design the next generation of devices, he said.

"So you start by outsourcing production... and end up outsourcing creativity," he added, saying that, at the same time, it hurt the home market because one "cannot sustain innovations in locations without a production base".

China still attractive

It is clear that changes are afoot for the "Made-in-China" model, but there is no massive production shift from China to other developed countries so far. China remains a favored investment destination for companies in the US, Europe and Japan, analysts said.

Susan Helper, an economics professor at Case Western Reserve University in Cleveland, Ohio, said that factors such as energy costs are making the US a more attractive place for manufacturers, but the numbers of jobs coming back to the US from Asia and Mexico have been small.

"What we have seen is when there is a new plant to be opened, management are now thinking where it should be, instead of automatically choosing China as the default decision," David Lee, a partner at BCG and head of the firm's China industrial goods business, said.

Geoff Li, a spokesman for GE, said GE emphasized both China and the US for manufacturing operations.

"As a technology-driven company, our decisions to invest in manufacturing, service and innovation centers are driven by a number of factors," he wrote in an email reply to China Daily. These include local market potential, GE's ability to service large local customers, the suitability of skills and education, the physical infrastructure and the legal and policy environment.

China is one of the most important manufacturing bases for GE and the company will maintain its overall manufacturing presence in China with expansion plans for some businesses, he said.

Sweden's Telefon AB L.M. Ericsson, the world's biggest telecom equipment maker, started manufacturing in China in 1992 and has built its largest production and supply hub in the world in the Eastern Chinese city of Nanjing.

About 40 percent of Ericsson's total global equipment is made in Nanjing. Melody Li, spokeswoman for Ericsson China, said Ericsson has found no reasons to shift manufacturing to its home market or other developed economies.

"We have benefited from the complete industry chain and sufficient capabilities of our suppliers in China's Yangtze River delta and Pearl River delta," Li said.

China's neighbor, Japan, also invests heavily in China's manufacturing industry, especially in cameras. Canon Inc, Sony and Nikon all have production plants in China.

"The US call for a manufacturing renaissance may affect China as a global manufacturing center, but the effect is very limited," said Wang Haifeng, director of international economics at the Institute for International Economic Research, which is affiliated to the National Development and Reform Commission.

The US advantages lie in middle- to high-end manufacturing, such as precision instruments, aviation and the telecommunications sectors, rather than in what China is specialized at now, he said.

"It is not likely that the low-end labor intensive manufacturing will go back to developed countries because it is not their comparative advantage nor what they are good at," he added.

The center of the global manufacturing industry has moved three times in the past centuries, according to Chen Wenling, chief economist with the China Center for International Economic Exchanges, a top think-tank.

The center used to be in Europe, mainly in the United Kingdom, Germany and France, with UK-made goods taking up two-thirds of global manufacturing volumes in the middle of the 19th century. The US then overtook Europe by World War I and, when World War II was over, US foreign trade volumes accounted for more than one-third of the world's total.

Asian dragons

The second transfer took place from the 1960s to the 1980s when Japan and the "Four Asian Dragons", referring to the highly developed economies of Hong Kong, Singapore, South Korea and Taiwan, replaced the US as the global manufacturing center. Japan then became the biggest producer of vehicles, steel and fiber.

That was followed by a gradual transfer of manufacturing to emerging markets, including China, India, Brazil and Russia. China, known as the world's factory for a long time, accounted for about 20 percent of global manufacturing in 2010.

If production returns to developed countries and even cheaper nations such as Vietnam and Indonesia, the manufacturing sector in China will face challenges.

The good news is China's manufacturing is also moving up the value chain, said Wang Haifeng at the Institute for International Economic Research. He recalled in the past that China mainly assembled imported parts of a product because it was unable to make the parts on its own. But now it can make a large number of things it couldn't in the past, for example, optical glass.

Meanwhile, China has its own advantages in attracting manufacturing businesses. The country will continue to be a manufacturing hub for many sectors, such as electronics, Lee at BCG said.

Take mobile phone production as an example. China is the world's biggest manufacturing base for the devices. The nation shipped more than 1.13 billion handsets in 2011, accounting for about 71 percent of the total number in the world, according to the Ministry of Industry and Information Technology.

In the southern coastal city of Shenzhen alone, approximately 70 percent of made-in-China mobile phones were manufactured, said Sun Wenping, secretary-general of the Shenzhen Mobile Communications Association.

"It is because of the unparalleled mobile-device production chain in China that no other countries can compete with it. Suppliers for mobile phone parts are almost next door," Sun said.

Unlike Apple, which probably takes a year to research and test a new model, Shenzhen's mobile-phone manufacturers have a much higher productivity rate.

"From the idea to the actual product hitting the market, the fastest Shenzhen producers only need 20 days," Sun said.

Gao Yuan contributed to this story.

Contact the reporters at shenjingting@chinadaily.com.cn

- Globalfoundries partners with Chinese city Chongqing on chip-making JV

- Private sector welcomed to invest in farmland irrigation

- Russian experts, officials confident about China's economy, currency

- Kenya, Chinese firm ink deal on key road construction

- World energy leaders agree at intl forum to expand clean energy deployment

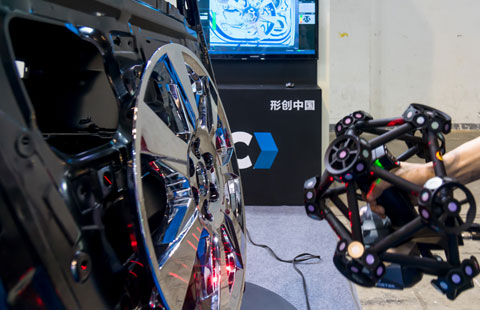

- Shanghai's 3D printing expo attracts over 100 companies

- US subpoenas China's Huawei in probe over exports to Syria, others: NYTimes

- Sportswear or examwear? Nike store targets exam takers in NE China