Central bank makes record cash injection

By Wang Xiaotian (China Daily) Updated: 2012-08-23 09:26Analysts have forecast more loosening measures soon, as economic data for July fell below market expectations.

Export growth in July dropped to 1 percent against a market consensus of 8 percent, while industrial output growth fell by 0.3 percentage points compared with June.

In addition, new yuan lending in July declined sharply to 540.1 billion yuan, the lowest level since September 2011, against 919.8 billion yuan in June, adding to market worries over a liquidity shortage.

"All activity data remained weak in July, suggesting China's slowdown is more severe than expected," said the Australia and New Zealand Banking Group Ltd in a research note.

"Imminent monetary policy easing and faster implementation of fiscal policy will help China's economy gradually regain momentum.

"We maintain our view that the PBOC will cut the RRR by 150 basis points this year, with the first cut by August," it said.

Jing Ulrich, managing director and chairwoman of Global Markets, China at JPMorgan Chase, said that any projected turning point in China's economy should now be postponed to the fourth quarter.

Introducing another large stimulus program this year, despite growing economic tensions, remains an option if conditions deteriorate sharply, according to a report released by Standard & Poor's Ratings Services on Wednesday.

"The government retains significant capacity to support economic growth, if needed, partly because of China's sizable financial assets," said Kim Eng Tan, credit analyst of S&P.

The government may be prepared to pump more money into the economy if the currently stable unemployment rate rises steeply, added the rating agency.

"We still expect real economic growth of 8.2 percent in 2013.

"But in 2012, growth could slow to about 8 percent, compared with average growth of 9.6 percent for the past few years," said Tan.

wangxiaotian@chinadaily.com.cn

- LeTV unveils new icon, aims to expand in US and India

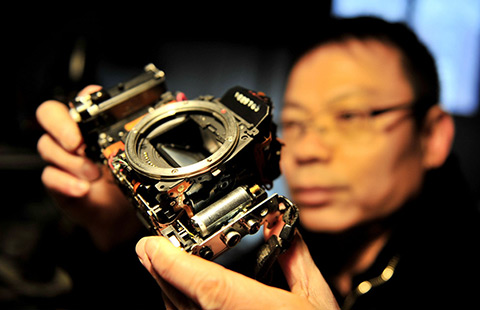

- Master gives new life to cameras in his 'hospital’

- Starbucks to open 2,500 China stores in next five years

- Rwanda mulls deal with Chinese investors to develop textile industry

- More foreign institutions allowed on China's forex market

- Major aluminum producers plan joint venture for commercial storage

- China loosens capital control for financial leasing firms at Tianjin FTZ

- China sees foreign trade surplus rise 25%, exports 2.3% in December