Suburban malls steal trade from city centers

By Wu Yiyao in Shanghai (China Daily) Updated: 2012-09-17 10:42Due to competition from new business formats, traditional department stores will continue to close or be upgraded over the next one to two years, the Knight Frank report said.

|

|

Retail properties can thrive in non-core areas because they are going with the tread of China's residential property development, said Alan Sun, an analyst with Knight Frank.

In first- and second-tier cities such as Shanghai, a large proportion of the population is living in non-core areas. They provide sufficient customer flow and stable demand for daily necessities as well as entertainment and recreational demand during weekends, said Sun.

If developers have made effective efforts to optimize the combination of tenants and maintain the properties well, it is very likely that non-core area businesses can excel in the long term.

"In Europe and North America, neighborhood communities are usually a successful business pattern that many developers follow. In China an increasing number of developers are doing the same," said Sun.

"I bought my apartment in Baoshan in 2007 and when I moved in there was no market around. I had to buy my necessities from bazaars held by local farmers during weekends. When I broke my thermos, I traveled 30 minutes to the nearest supermarket, taking buses and the subway," said Ge Ting, a 27-year-old IT specialist and frequent visitor to Baoshan Wanda Plaza.

"For me it looks like many other commercial complexes in the city but it is just a stone's throw from my apartment and it has got almost everything I need for my life. I have no reason to go elsewhere," he added.

Another shopping center located in a non-core area in Shanghai and opened last quarter was the Life Hub @ Anting in Jianding Anting Town, close to Metro Line 11 Anting station. It has a retail gross floor area of 65,000 sq m. The retail market is active and developers and retailers are optimistic.

Despite its distance from downtown areas, non-core retail areas may attract local residents with an optimized combination of functions and brands, said Fanny Leung, vice-president of Chongbang Group, the developer of Life Hub @ Anting.

"We paid a lot of attention to entertainment facilities so young people can socialize here, have quality time and can enjoy the latest movies here not a single second later than those in downtown areas," said Leung

Leung said the group has confidence in non-core areas around Shanghai because it believes they have great potential.

"We are still negotiating over several possible projects on the outskirts of Shanghai," said Leung

A reasonable combination of brands will draw more customers even if the locations are not in currently prestigious areas, said Leung

The long-term challenge, however, lies in financial pressure which may hinder developers' capability and passion in maintaining the properties in the long term.

The current financing environment in China does not encourage developers to maintain a project for the long term, and many developers cannot afford the cost of maintaining a large group of professionals running the project with every possible resource. The result is that quite a number of developers choose a quick-money option - building the project and selling it as soon as possible.

After the introduction of several policies to curb speculation in the residential property market, many developers are beginning to switch from housing projects to retail property development, according to Edward Cheung, chief executive officer at DTZ's North Asia operations.

Decision makers understand that retail is a significant driver of economic growth and it will benefit various parties in the economic development of China, said Cheung.

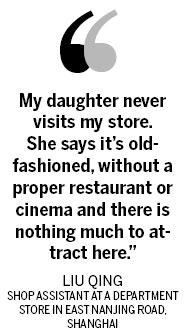

In core-areas, traditional department stores in Shanghai have little ability and likelihood of getting back on their feet as shopping malls with homes and offices steal a large share of the retail market, said Sun of Knight Frank.

"If you want to stay in core areas, you must sell products or services with high profit margins that can balance the high cost of rent," said Sun.

Traditional department stores can no longer meet the demands of customers but they may survive if they review their current situation, adjust strategies and perhaps re-brand their services, said Sun.

Retail is the founding stone of a city's commercial activities and it is, of course, better to see more variety, said Sun.

wuyiyao@chinadaily.com.cn

- Ant Financial 'in talks' with Caixin Media

- Picky Chinese invest smartly in overseas residential units

- National big data pilot zone to open in Guizhou

- China Resources to buy out stake in Snow Breweries

- Beijing smart glasses maker eyes global market

- World premiums at Geneva Motor Show

- Based in China, trading in US stocks

- China offers guidelines for companies investing overseas