Great Wall Motors defies industry slowdown

(bjreview.com.cn) Updated: 2012-10-15 16:02The brand concept - concentration, profession and proficient - makes Great Wall distinctive, highlights its aspiration to build a world-class brand.

"Great Wall Motors has the money and ability to develop independently. This may explain why we have no plan to establish joint ventures with our overseas counterparts," said Shang, "but that doesn't mean we refuse to team up with competent parts makers.

In fact, international cooperation is a distinguishing feature of Great Wall Motors. For example, we have cooperated with Le Groupe Dassault, Bosch, BorgWarner and Valeo in engine, transmission and vehicle design. Such collaboration allows us to expand our global network."

For the first eight months of the year, the carmaker sold 378,600 units while its year-end sales goal is 600,000 units. Great Wall Motors says that by 2015 its production capacity will reach 1.5 million units, with a sales target of 1.3 million units.

Overseas expedition

As its own auto market slows, China's exports to overseas markets are surging. According to the the China Association of Automobile Manufacturers, the country exported 814,300 vehicles in 2011, 49 percent higher than in 2010. Among the domestic manufacturers, Great Wall Motors exported 83,000 units, among which there were 13,200 sedans, 34,300 SUVs and 35,600 pickup trucks.

For the first seven months of this year, it exported 63,995 units, up 16.75 percent from the same period last year. Now, Great Wall vehicles are seen in more than 100 countries and regions with 800 dealers present in 80 countries.

|

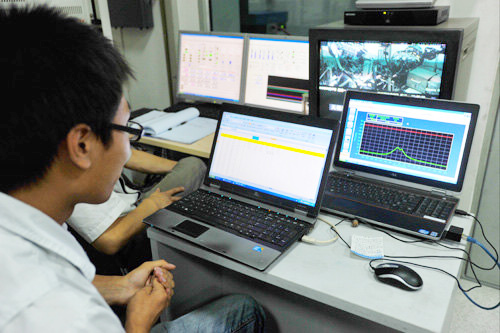

A worker analyzes test data at the Vehicle Emissions Testing Laboratory of Great Wall Motors. [Photo / bjreview.com.cn] |

Great Wall Motors is preparing to increase in exports to emerging markets. "They are easy for us to operate in," said Shang. Russia is now Great Wall's largest export destination. A quarter of Great Wall's total exports last year, 20,000 vehicles, were sold to Russia and sales in the country are expected to total 100,000 vehicles in 2015.

"While we have previously targeted emerging markets, our latest desired market is the EU," said Shang. Great Wall Motors just launched operations in Bulgaria in February, becoming the first Chinese automaker to assemble cars in the EU. Since Bulgaria is an EU member, the project provides Great Wall Motors with access to other EU countries at zero tariff levels. The UK recently welcomed its first model - Great Wall's Steed double-cab pickup, built at the Bulgaria plant with a selling price of 13,998 pounds ($22,404).

Challenges

Global automakers have made their models as affordable as domestic brands.

Even though Chinese carmakers have scored well in automotive crash testing, changing motorists' perceptions of the inferiority of domestic brands will take time. Great Wall Motor is no exception and its brand remains weak both abroad and at home.

"We are confident in our overseas moves. Although we're still suffering from a weak brand image and consumer doubts, we have been met with great popularity in the low-end market," said Shang. Lower prices always seem more appealing. The roomy and well equipped Haval H6 is priced between 110,000 yuan to 120,000 yuan, while Honda's CRV with similar features costs about 180,000 yuan to 200,000 yuan. In the EU and the United States, a locally produced pickup usually costs $100,000 or more, while a Great Wall pickup is priced at $10,000 to $20,000.

In the United States, Japan and South Korea, where the auto industry is quite developed, customers are more loyal to familiar brands. "Higher thresholds in these countries make it difficult for us to enter," said Shang. Nonetheless, the carmaker is eyeing Canada and the United States.

Great Wall's exports are expected to top 300,000 vehicles in 2015. By that time, exports should account for 20 percent of its total sales.

To become a world-class player, Great Wall Motors may have to shift to a more extensive development model. Further improvements should be made in after-sales service, Shang said. Another major hurdle in its development is its current sales network and overall customer service, which lag behind competitors. Great Wall Motors still needs to upgrade its enterprise management system and enrich its corporate culture, he said.

- COSCO's acquisition of Greek Piraeus Port to further contribute to local economy

- Throughput of Tianjin port to see a marked increase

- BMW to recall vehicles in China

- Greek president hopes for more investments following Piraeus Port Authority deal

- Jaguar Land Rover to recall 36,000 vehicles in China

- More lock-up shares eligible for trade

- OnePlus plans customized, single operating system to attract global users

- China's economic planner plays down pork inflation fears