Winter blues for textile makers

By Yan Yiqi and Zhang Jianming (China Daily) Updated: 2012-10-29 13:59

|

|

|

Jishan Dyeing Plant has adopted advanced printing technology to reduce environmental pollution. Yan Yiqi / China Daily |

Clothing companies in a county in East China are turning to innovation to beat downward trend in global orders

|

|

|

A view of East Market of China Textile City in Shaoxing county, Zhejiang province. Yan Yiqi / China Daily |

The saleswoman next door is chatting with another one across the hall, and one of the main topics, apart from children and husbands, is how rotten business is at the moment.

Huang is a sales assistant at Zhejiang Weizi Textile, which owns two stores in the East Market of China Textile City, the country's largest market for textile products in Shaoxing county, in Zhejiang province, East China.

Trade has been this slow for several months, she says, and for small factories like the one she works for the problem is acute.

"It should still be Western customers' Christmas buying season, but you can see exactly what it's like."

This one corner of China's largest textile market covering an area of 3.2 million square meters is a microcosm of the business climate in Shaoxing county.

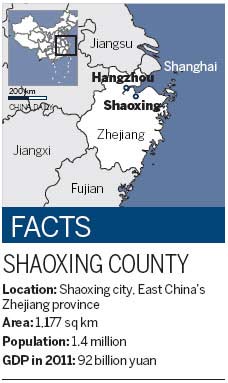

Shaoxing hosts the densest concentration of textile businesses in the country, with more than 1,000 large-scale textile companies generating a total annual turnover of 153.8 billion yuan ($25 billion; 19 billion euros). Textiles account for 64.5 percent of production in Shaoxing, says He Jiashun, the county's Party chief.

"Shaoxing's economy is bound by a piece of cloth. A quarter of the world's textile product trading in terms of quantity is done through China Textile City here."

But He says Shaoxing's booming textile industry has faced many hurdles in its efforts to expand.

In the first three quarters of this year China Textile City sales revenue was 59.3 billion yuan, a 7.5 percent rise year-on-year. Revenue has grown an average of 10 percent in recent years, says Shou Lumin, deputy director of the Construction and Management Committee of China Textile City. From January to September China Textile City's average monthly exports were $255 million (195 million euros), a rise of 7.6 percent year-on-year.

While that performance outshines the meager 0.54 percent growth for textile exports nationally, pressure still weighs heavily on Shaoxing.

"We're not going to say shrinking external demand has had no influence on our member companies this year," Shou says. "On the contrary, we have heard many small companies complain about how difficult business is."

Yu Qi is sales manager at Shaoxing Qingwu Textile, one of the small companies that says it has suffered as orders have fallen. Yu's company's products are sold mainly in economically beleaguered Italy, and she says sales revenue from there has been particularly low since the end of last year. In fact, profits this year may barely be half of what they were last year, she says, refusing to go into details.

"It is not that we don't have orders. In the first half of this year the number of orders from foreign clients grew 15 percent compared with the same time last year. The problem is the prices they offered were too low, so we decided not to take them."

Yu says that if she turns down their orders, that decision may come back to bite the company later on, but if she accepts them, it will hurt the company right now, she says.

"The more orders, the more we lose."

Yu says her company has about 30 workers, and to save costs they are encouraged not to turn up for work three or four days a week.

"Our boss says he will not cut numbers, even though at the moment we really do not need so many workers, but we are afraid that if things improve we will end up being short-staffed."

- Chinese bank launches first US credit cards

- Cisco, China's Inspur form Internet tech JV

- IMF welcomes Chinese efforts to tackle high corporate debt, bad loans

- Western media should abandon bias against China's growth figures

- VAT reform to reduce 20% of hotel tax burden

- China's industrial profits growth quickens in March

- China's debt unlikely to trigger shocks, says Moody's

- Shenzhen second-hand home sales tumble