Outsourcing's trials and tribulations

By Wei Tian (China Daily) Updated: 2012-11-12 09:27End of linear growth

By May this year, there were nearly 17,000 outsourcing companies in China employing about 3.5 million staff, among which 70 percent had an educational background of junior college level or above.

The boom in both the revenue and the number of employees, as well as the profits, used to be directly related in that if the staff doubled in size, the revenue and profits would also double accordingly.

The phenomenon was a result of a staffing model widely adopted in the outsourcing industry typical of which were the lower-paid workers sent to the client company by Yang's former employer.

Under this model, employees of outsourcing companies would work on-site with their clients, with their employer being paid monthly on a head-count basis. It is supported by millions of graduates from second- and third-tier colleges hungry for work. Many outsourcing companies exploited their need, hiring more employees because "the more people you send out, the more money would come in."

Those times now appear to be over as increasing labor costs and tougher competition squeeze profits.

"Over the past 10 years, the cost of a software engineer has risen four-fold but the clients' bid price has less than tripled," said Liu Jiren, chairman and chief executive officer of Neusoft Corp, another key player in China's outsourcing industry.

|

|

|

Chinese IT solution and service supplier Neusoft shows its company logo at a technology fair in Beijing. The annual revenue from offshore-outsourcing businesses for Chinese vendors has been growing at more than 50 percent annually over the last three years, according to data released by the Ministry of Commerce. [Photo/China Daily] |

As the number of companies increase, vendors' bargaining positions weaken because everyone is offering lower rates. "It is difficult for them to pass on the rising labor costs to the clients so the vendors' margins drop," Liu said.

Although the number of employees and the size of revenues continue to expand, outsourcing companies now face lower profit margins from a peak of 30 to 50 percent to less than 10 percent.

One consequence is an increase in the number of people changing jobs, as Yang did. In recent years, China's outsourcing companies have had to deal with losing more than 30 percent of their employees a year. In some companies the proportion is higher than 50 percent, although new faces can quickly fill the vacancies.

"At least half of the enterprises still rely on the head-count model. They will probably be eliminated by the reshuffle within the industry if they don't adapt to the changes," Liu said, adding that his company is shifting its focus from the expansion of its business scale to the pursuit of a sustainable business model.

Some companies have chosen to confront the difficulties by merging, such as the one between Vanceinfo and HiSoft Technology Intl in August, which created the largest offshore IT services provider by revenue in China.

The economy of scale created by the merger is expected to save 65 million yuan in administration costs a year, and therefore lift the profit margin by 2 to 3 percent, according to a report in 21st Century Business Herald. That would be a significant improvement in an industry where the average profit margin is 10 percent.

However, the market responded to the strategy negatively. Shares of Vanceinfo on the New York Stock Exchange dropped as much as 13 percent the day after the merger was announced, while those of HiSoft fell 7 percent on the Nasdaq.

"We see more companies striving to cut their costs as they face difficulties but the key to this issue lies in identifying new opportunities and increasing the value created by each employee," said Qian Fangli, director of the China Outsourcing Institute, which is affiliated to the Ministry of Commerce.

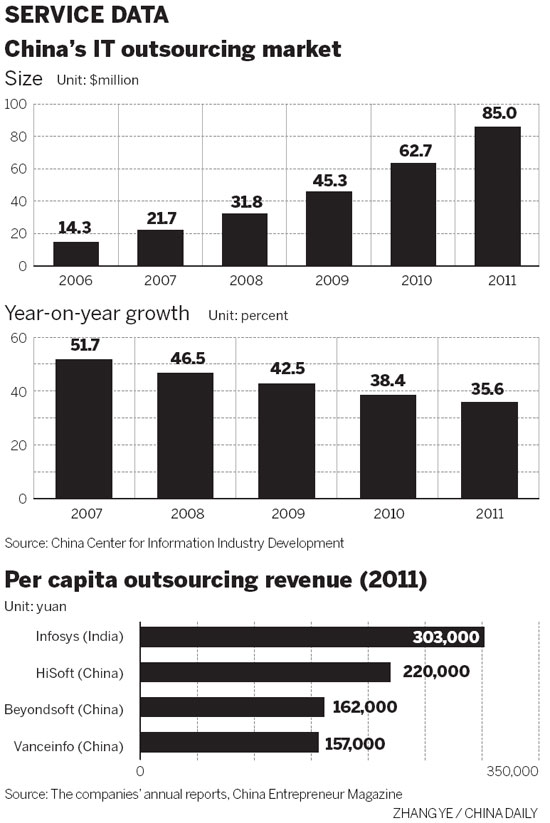

In terms of the annual revenue per capita in 2011, a Vanceinfo employee would generate less than 160,000 yuan a year. HiSoft employees were a little bit more productive but it was only slightly more than 200,000 yuan, a figure considered to be the cut-off point for Chinese vendors when the size of the company reaches a certain level.

Compared with their Chinese counterparts, employees of Indian outsourcing companies have a much better time. At Indian firm Infosys Ltd, a world leading outsourcing company, although the number of employees exceeds 150,000, the revenue per capita is around $50,000 a year, twice as much as that at average its Chinese counterparts.

While China's vendors struggle with a profit margin of 10 percent, Infosys maintains a profit margin of 25 percent.

- SoftBank to sell 4% stake in Alibaba

- China Caixin manufacturing PMI slips to 49.2

- PBOC pumps 25 billion yuan into market

- Zoomlion exec says price disagreement led to Terex failure

- China pins hopes on scientific innovation

- Russia seeks to promote EAEU-China economic cooperation: FM

- China, Malaysia promote twin industrial parks for cooperation

- US still tops China's overseas portfolio investment list