Contractors land more deals

By Bao Chang (China Daily) Updated: 2012-11-24 09:18

But risks loom in developed markets due to economic woes, protectionism

Chinese offshore contractors have landed more deals in developed economies as part of efforts to enhance their global presence, China International Contractors Association said on Friday.

In the first three quarters of this year, Chinese contractors' share of traditional markets in Asia and Africa has declined, while their growth has picked up in medium- and high-end markets in Europe and the Americas.

Contracts signed in Europe reached $6.56 billion in the first three quarters, up 17.4 percent year-on-year, while the figure was $10.9 billion in Latin America, a year-on-year increase of 43.3 percent, according to the association.

Countries including Germany, Sweden and the United Kingdom have also become more active in inviting Chinese contractors to construct large-scale infrastructure projects.

"Chinese contractors will undoubtedly get a foothold in high-end construction markets in developed economies," said Wang Xiaoguang, director-general of the overseas department of China Communications Construction Co Ltd.

"However, within a short time, Chinese construction enterprises' market share in developed economies won't see obvious growth due to fiscal restraints in the US and Europe and protectionism," Wang said.

Diao Chunhe, director of the association, said at the annual session of its council on Friday that China's construction contractors are set to face bigger risks in their overseas business next year, as they enter more developed markets.

"In 2013, China's offshore contractors may face quite a number of challenges from the deteriorating business environment abroad, as well as rising protectionism and competition from Japan and South Korea," said Diao.

The association is a government-backed organization under the Ministry of Commerce, which makes policies, provides services and conveys proposals from its members to the government on behalf of Chinese international contractors.

The sluggish global economy has resulted in the revival of protectionism globally. In overseas markets, some anti-dumping investigations and unreasonable environmental standards targeting Chinese contractors have hurt Chinese companies' overseas development, according to Diao.

"More risks will come from advanced markets next year," Diao said.

From October 2011 to May 2012, World Trade Organization members implemented 182 trade restricting measures, influencing 0.9 percent of the value of global imports, according to the WTO.

Some countries are not enthusiastic with regard to foreign participation in their emerging industries.

"As host governments tend to offer opportunities to local contractors in a move to protect local industry, China's overall offshore construction business is set to slow down in the coming year," Wang added.

Li Jiqin, general manager of the overseas business department of China State Construction, another major player in the industry, said that it is confronting a bottleneck in the US market. Some US government officials and companies are biased against Chinese contractors, he said.

"It's becoming more difficult for Chinese contractors to expand in the high-end building market of developed economies," said Li, adding that China's merger and acquisition activities in the US construction industry are blocked by protectionism, which cites "state security", resulting in a series of policy and legal restrictions for Chinese contractors.

CSC has been expanding in the US since 1985 when the company established its first subsidiary in the country. Over the past decade, the US subsidiary has maintained annual growth of more than 40 percent. As an influential building company in the US, it generates revenue of $700 million annually and more than 95 percent of its 1,500-strong workforce are local hires.

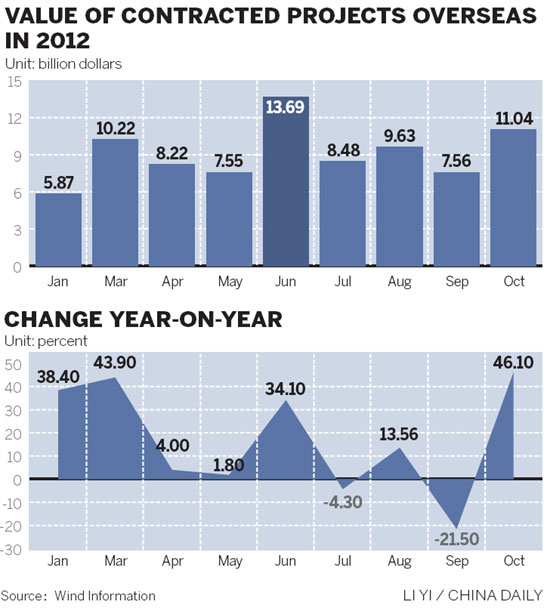

From January to October, China's overseas construction contracting sector registered revenues of $87.06 billion, an increase of 14.4 percent year-on-year.

baochang@chinadaily.com.cn

- Midea to acquire 80% stake in Italy's Clivet

- Lenovo to fund HK start-ups

- China has $5.6 trillion productivity opportunity by 2030: McKinsey

- Russian petrochemical firm hails cooperation with China

- Central bank pumps more money into market

- Online infringements cost $13.8b a year

- Working under the scorching sun

- China suspends oil price adjustment