UBS bullish on China's prospects

By Gao Changxin in Hong Kong (China Daily) Updated: 2012-12-07 09:24Policies unlikely to change next year as economy heads toward path of recovery

The Chinese economy will grow faster next year amid policy continuity and stability, the investment bank UBS AG said on Thursday.

A property-market rebound combined with strengthened infrastructure spending and the end of corporate de-stocking will support a growth rate of 8 percent, 0.4 percentage points higher than the estimated 7.6 percent this year, UBS economist Wang Tao said in a conference call.

"China is already on a modest recovery path. Next year is for recovery," Wang said.

UBS' estimate falls 0.2 percentage points short of the 8.2 percent forecast by the Chinese Academy of Social Sciences, a top government think tank.

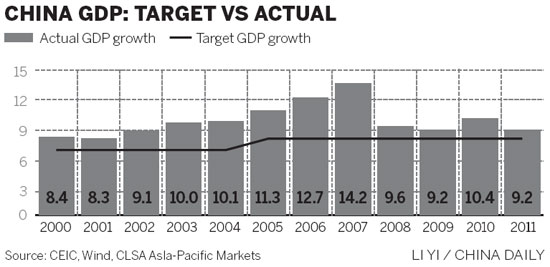

But it's still optimistic compared with CLSA Asia-Pacific Markets, a brokerage, which said in a report published on Thursday that the government will have to adopt stimulus measures to meet a target of 7.5 percent.

Growth has picked up in the second half. The economy expanded 9.1 percent in the third quarter in annualized terms from a quarter earlier, well above the government target of 7.5 percent.

Wang predicts that quarter-on-quarter growth in the last quarter will pick up to an annualized 9.5 percent.

A modest rebound in the property market will lay the ground for growth next year, he said.

The tightening policy tone toward the market is unlikely to change, but minor redresses are possible.

Home-purchase restrictions will remain in place and mortgage rates might be lowered, Wang said.

Media reports show that some lenders have already started discounting mortgage rates, in some cases up to 15 percent.

The Ministry of Housing and Urban-Rural Development has said that construction of 6 million affordable homes will begin next year. That is 1 million lower than this year, but ongoing construction left over from previous years will help make up the gap.

Wang predicts a 5 to 10 percent increase in property sales as well as modest price increases next year.

Nationwide, 70 million square meters of residential housing has been sold so far this year. CLSA predicts a total of 80 million square meters will be sold for the whole year and 84 million square meters next year.

But both UBS and CLSA said they believe no big policy changes will take place in the near future despite the change of leadership.

"A lot will remain the same ... but the government will increase social spending and investment," Wang said.

Francis Chueng, a CLSA strategist, said he believes that policy won't change much until 2014, expect for incremental change in financial and pricing reforms and population policy.

Investment in infrastructure, which has long been a main growth engine in China, will also step up next year, Wang said.

In the latest evidence of the government's support for infrastructure construction, the National Development and Reform Commission approved projects totaling 90 billion yuan ($14.47 billion) last week.

Chueng said he is worried about whether the projects can be financed. The high level of local debt makes it hard for local governments to get enough financing for new projects.

gaochangxin@chinadaily.com.cn

- Top 10 best Chinese cities to own a house

- Robots to be game changers in express delivery sector

- Content businesses emerging as a 'showcase for growth' in the region

- Fintech helps China's internet giants draw their financial roadmaps

- China biggest alumina producer's profit hits 5-year high

- Online shopping complaints rise 87%

- Shanghai G20 meeting vitally important for New Zealand trade: Minister

- China auto sales up 14.6% in June