Rural riches

By Lin Jing and Su Zhou (China Daily) Updated: 2012-12-18 16:46Shunyida General Merchandise Firm, for example, once only had a brick-and-mortar store in the village but now also has two online stores selling ceramic pots and tools used in brewing tea. In the past month, the company has sent out about 100 parcels a day.

|

|

|

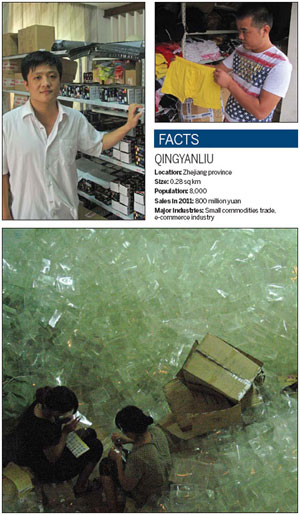

Top left: Wang Hao in his stock room. Top right: Xie Zuoshou, the owner of an online underwear store. Above: Workers inflate plastic cushioning bags for the express delivery business. Photos by Lin Jing / China Daily |

"For online stores, we have to face individual consumers, while in the physical store, we only have to deal with distributors, who better understand our products and are not so picky," says Zhang, who adds that the company still sees e-commerce as the best way of helping the business to grow brand over the long run.

In April last year, the company set up Mateng E-commerce Co to market two online brands called Bolvya and Taobaowang in its stores.

Zhang says they will try different promotional strategies. In September they listed one ceramic pot on Juhuasuan, a group-buying site under the umbrella of the e-commerce giant Alibaba Group Holding Ltd. The price was 97 yuan, compared with the original 233 yuan.

"With this promotion, we plan to draw more traffic to our online store and increase the exposure of our own products," Zhang says.

However with all this growth one problem is an emerging shortage of talent, something of a hot-button issue in the industrial regions of China.

Chen Shousong with the local consultancy Analysys International says the rapid development of e-commerce has not only jumpstarted regional growth, but also redefined the business model for traditional offline companies. This, in turn, has raised higher requirements for workers in various fields, including customer service and website design.

"The total shortage of talents in the city is about 400,000 to 500,000," Liu says. "Though the local school here, Yiwu Industrial & Commercial College, has talented students, they still need to gain experience and learn new skills. Now the association is cooperating with other schools to train e-commerce talent."

Meanwhile, many companies have outgrown the cozy village because their annual sales have on average exceeded 20 million yuan.

Liu says the current structure in Qingyanliu is not suitable for large e-commerce companies. He says that after two years it's natural for many companies move out of the village.

"As business keeps growing, some companies will need a warehouse that is 2,000 sq m or more for inventory, while rooms in Qingyanliu are limited to 100 sq m. So after a year or two, they will move out of the village to industrial parks nearby," he says.

Xie Zuoshou, the owner of BJ Mall, an online underwear store, is one such company. "Qingyanliu is only an incubation center. But companies with a bigger plan have to move out," he says.

The company made about 17 million yuan of online sales last year, and Xie expects 30 million yuan within two years. He plans to move the company to a 2,000-sq-m warehouse in Beiyuan Industrial Park Zone in Yiwu.

He says that small companies may feel the online supermarket is fine, but for bigger companies, the supply chain is of great importance.

"If e-commerce companies want to survive, they have to either cooperate with factories or invest in production. With my own factory, I can better control the supply chain and product quality."

Yang Xiao, another analyst with Analysys, says that for companies starting online, e-commerce is only a means, not an end.

"In the long run, they still need to pay attention to the basic elements of business, such as services, company operation and supply chains," Yang says.

The Qingyanliu phenomenon has been seen in many towns and villages across China over the past three years.

The number of e-commerce companies registered in villages and towns rose from 306,000 in 2009 to 590,000 last year, while the number of employees in e-commerce companies in these villages grew from 450,000 in 2009 to 970,000 in 2011, according to a recent report by the Chinese Academy of Social Sciences.

Though many other areas are trying to catch up, such as Shaji town in Jiangsu province, which focuses on the production and sales of furniture, Liu is confident Qingyanliu will maintain its place as the best place for startups.

"The other areas cannot compete with Qingyanliu. They lack a complete industry chain, from printing and advertising to packaging and logistics."

Liu says that the association is investing at least 30 million yuan to build a warehouse that will open by the end of the year, providing additional packing and delivery services.

"In the future, if people want to start e-commerce companies in the village, they will only have to keep an eye on their business sitting in front of the computer and leave all other jobs including packaging, graphic design and logistics to us."

Contact the writers at linjingcd@chinadaily.com.cn and suzhou@chinadaily.com.cn

- NEV makers short of cash in tricky market

- Door opens for removal of stake caps for carmakers

- High recalls no cause for alarm

- Joint scientific research drives traditional Chinese medicine westward

- Warcraft wows Chinese, sows seeds of fan economy

- Rising bad loans shift banks' focus to risks and debt securitization

- A-shares shiver as yuan weakens

- Sonova hears China's message loud and clear