| |

|

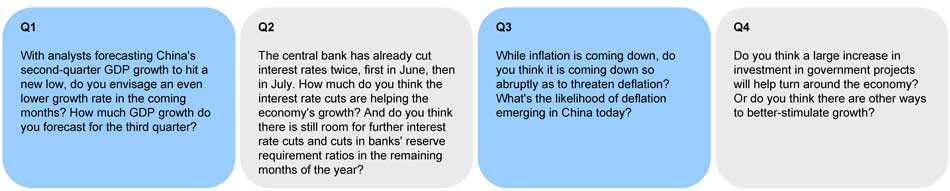

Editor's Note: Once again, China's economy is at a crossroads. Worrying developments have been spotted in its second-quarter performance, the results of a slowdown in business at home, and dwindling orders from Europe and Japan. This is quite a different picture from the beginning of the year, when inflation, rather than a lack of growth, was the economy's No 1 enemy. After Premier Wen Jiabao pledged earlier this week to keep China's growth rate going, some quick adjustments can be expected to be seen in how Beijing runs the world's second-largest economy. Where will they occur? Will they be effective? What industries can expect to see early benefits? And how well will the general economy fare in the remainder of the year? China Daily has invited some leading economists to share their thoughts.

Previous Issues: | |

No short-term end to eurozone crisis No short-term end to eurozone crisis |

What should China do if Greece quit eurozone? What should China do if Greece quit eurozone? |

How can China avoid a hard landing? How can China avoid a hard landing? |

|

|

If economic indicators continue to deteriorate in the third quarter, I think there is still room for further cuts in interest rates and reserve requirement ratios.

In economic theory, a period of deflation always follows a period of inflation. It's a normal economic cycle. So deflation is just a matter of time. But I think if it is handled well, deflation will not occur in the second half of this year.

This is not a repeat of the massive stimulus package of 2008, during which the central government approved a bunch of infrastructure projects. What's more, the speeding up of approvals is taking place on a very selective basis. I think it is important to activate private capital by lowering the thresholds in several industries. director of the Institute of Fiscal Science, a think tank affiliated with the Ministry of Finance, | |

|

It is likely to rebound to 8 percent in the third quarter and 8.5 percent in the fourth after hitting the bottom in the second quarter.

Banks should greatly lower various kinds of fees to reduce companies' financing costs. Given the current decline in funds outstanding for foreign exchange reserves and eased inflation pressures, room remains for further cuts in banks' reserve requirements for the rest time of the year.

Besides, the government has introduced favorable policies to promote environmental friendly projects, energy-saving vehicles and energy efficient appliances, as well as measures to boost exports by adjusting relating fees, to ensure steady growth in the second half. -----Niu Li

| |

|

It is often the case that an economy will grow slower during a structural transition. China will likely grow slower in the range of 7 to 8 percent in years ahead compared to an average growth of more than 10 percent in the past decade. But this should not be cause for pessimism. What really matters is the perceived growth differential between China and the rest of the world in the long run, a gap that still clearly favors China.

We forecast there will be another cut in interest rates by 25 basis points in the coming months, and two cuts in RRR, each by 50 basis points.

The inflation level in China is still high - although CPI has declined. Otherwise the government wouldn't need to continue having tight controls on the property market.

If that were the case, aggressive loosening of monetary policy would contradict its goals. The pent-up demand for property accumulated over the past two years could be explosive. The fastest way to boost growth is to loosen credit controls and restrictions on the property market simultaneously. But policy makers know too well the consequences of pursuing this route. If domestic demand retreats further for whatever reason potentially the "Grexit" and its resultant rippling effects across financial markets worldwide the right response should be a Keynesian solution. The size of the stimulus package needs not be akin to the 4 trillion yuan launched in 2009. The essence is rationalizing capital allocation with an aim to yield long-term economic gains instead of offering temporary respite to prop-up growth in the short term.

senior vice-president and senior economist at DBS Bank (Hong Kong) Ltd

| |

|

The economic slowdown since the beginning of this year differs from the deterioration in 2008 in that the employment rate has not sharply dropped. Thus there is no need to overly worry about the short-term dip.

The central bank's recent two asymmetric cuts of one-year benchmark interest rates are expected to decrease commercial banks' profit margins in the short term and reduce manufacturing companies' financing costs, which could encourage them to increase production. In the third and fourth quarters, it is possible that the People's Bank of China may continue to lower the RRR because current market liquidity is insufficient.

However, deflation is not possible for China, as steadily growing labor costs are expected to boost prices in the medium to long term. The current decline in new orders points to weakening market demand, but it is only a temporary scenario influenced by the gloomy economic environment. The government should watch out for potential "over stimulation", which may result in more serious excess production capacity and do more harm to economic development.

As the government has stated that it will not ease property curbs, one of the possible "hot investment fields" may be the urban transport system, including building subways and improving the bus network. This is a good opportunity to promote companies' technological upgrading, which can help to improve their production efficiency and increase profit margins. In addition, investment in healthcare should be accelerated.

vice-president of the Academy of Macroeconomic Research of the National Development and Reform Commission

| |

|

My prediction is that the third-quarter GDP growth rate will be 8 percent, and 8.3 percent in the fourth quarter, which adds up to growth of around 8 percent for the whole year. Eight percent is an appropriate level for both employment and inflation. Unlike the massive unemployment seen in 2008, the job market remains steady, with some areas even offering higher salaries to compete for employees, suggesting that the economy is still within a comfort zone.

But despite all these efforts, the key figure to be looked at should be the actual amount of money injected into the economy, money supply growth. If the above measures are adopted, new yuan lending this year will be around 9 trillion yuan ($1.4 trillion), up from 7.5 trillion yuan last year, and the broad money supply (M2) growth rate will be around 14 percent.

June's CPI of 2.2 percent was mainly dragged down by retreating food prices, which account for one-third of the basket and are heavily dependent on seasonal factors. CPI may pick up again in the second half. Meanwhile, service prices remain high, meaning that some appreciation, such as in labor costs, is irreversible. Another reason is that commodities prices are already stabilizing, which will ease the pressure on downstream industries and create conditions for steady economic growth.

As the authorities maintain property curbs and the manufacturing sector struggles amid weak domestic and overseas demand, infrastructure will be the main destination for investment. Infrastructure projects do not necessarily refer to highways and railways, subways and regional airports could be good choices for this round of investment. -----Zhu Baoliang chief economist at the State Information Center, a think tank under the National Development and Reform Commission

| |