Corruption curbs crimp luxury market

By Wang Wen (China Daily) Updated: 2013-01-17 03:25Government moves to fight corruption will have some surprising effects, including putting a possible dent in the market for luxury goods, as Wang Wen finds out.

Strict government regulations to ban officials' consumption of luxury items are expected to soften the luxury goods market and change patterns of consumer consumption.

Statistics from the Federation of the Swiss Watch Industry show that Swiss watch exports to the Chinese mainland dropped 27.5 percent year-on-year in September.

|

|

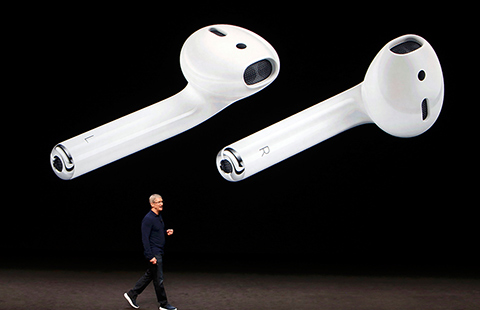

A pedestrian walks by a Swiss watch advertisement in downtown Shanghai in September 2011. Jing Wei / for China Daily |

China's demand had been weakening through the year, but September was the worst, followed by another 12.3 percent fall in October, noted Ren Guoqiang, a partner at Roland Berger Strategy Consultants in China, a consulting firm based in Germany.

Ren said government officials, who used to be the main recipients of luxury watches as gifts, were unsure about the future policy environment.

Several government officials who were noticed by the public to own luxury watches were investigated for corruption in 2012. One was the director of the provincial administration of work safety, who wore a Swiss watch when appearing at the site of a highway accident.

Officials are cautious now about receiving gifts, Ren said.

"It hurts the luxury watch business a lot," since more than 25 percent of the luxury items sold on the Chinese mainland were used as gifts.

The government has made a new regulation banning government officials from using public funds to buy luxury items. The regulation was made in July and came into effect in October.

The regulation specifically restricts buying luxury items as gifts, especially products such as men's watches and garments, said Bruno Lannes, a partner of Bain & Co, a consultancy based in the United States.

Bain & Co shows that the yearly sale of luxury watches would fall 5 percent on the Chinese mainland in 2012, whereas in 2011 the figure rose as much as 40 percent.

Domestic distributors were also hit.

"The ban will have an adverse effect on our watch sales," said Sun Xuguang, the operations manager at Sparkle Roll Group Ltd, a Hong Kong-listed luxury dealer of Swiss independent watch brands, including Parmigiani and DeWitt.

Very high-end watches are eye-catching and easily recognized by the public and so will be affected more, Sun added.

The recent ban on public money for luxury goods has had an impact not only on sales, but also on consumer trends.

Buying gifts, which will remain an important part of luxury spending, is moving away from items with logos due to the extensive exposure on social media, said Lannes.

Meanwhile, low-key luxury products, or those without obvious logos, are likely to get more popular, such as tailor-made suits and shirts, said Zhou Ting, director of Fortune Character Research Center.

On the other side, the consumer market will change.

"The new money in second- and third-tier cities will become the main consumers of luxury watches, rather than government officials," Zhou predicted.

The future consumers of luxury watches are mainly private entrepreneurs. The number of China's multimillionaires surpassed 1.02 million in 2011, according to the China Rich List released by Hurun Report. "The multimillionaires can support the luxury watch market," Zhou said.

As China's economy develops along with the public's ideas of consumption, ordinary consumers will also buy luxury watches, even if they have to save money for a while, Zhou said.

Luxury watch brand companies are still optimistic about China's market, although its growth is slowing. Some niche brands recently entered China and some attracted Chinese consumers even before they appeared in the market.

"We do not have any distributors in China yet, but our products already have Chinese consumers who bought the watches overseas," said Laurent Lecamp, founder and managing director of Cyrus Watches RL SA, a Swiss manufacturer of sporty-looking watches.

Despite the recent low growth in watch sales in China, Lecamp said his company will still come to the country.

- Consumption services set to dominate equity investment in China: report

- Nearly 70 SMEs debut on New Third Board

- China's Moutai profit up 6.7% in Jan-Aug period

- More lock-up shares eligible for trade next week

- Airplane restaurant opens in Wuhan

- China, Serbia, Hungary make progress on Budapest-Belgrade railway deal

- China's high speed railway exceeds 20,000 km

- Vice-Premier urges supply-side reform to upgrade manufacturing industry