Big three oil companies see earnings fall

China's big three oil companies have all reported a decline in earnings in 2012, blaming government price controls and rising taxes.

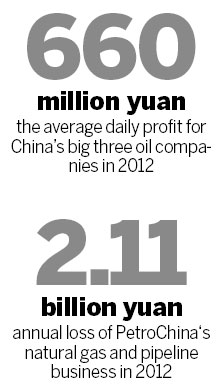

But they still raked in an average of 660 million yuan ($106 million) a day in profit in the past year, showing the strong profitability of the largely government-regulated sector.

China Petroleum and Chemical Corp, CNOOC Ltd and PetroChina, the listed arm of China National Petroleum Corp, earned a total of 242.5 billion yuan, down more than 10 percent year-on-year. But the figure is still more than double that of Warren Buffett's Berkshire Hathaway.

Asia's biggest refiner China Petroleum and Chemical Corp, or Sinopec, was the last to report 2012 earnings, saying on Sunday that profit fell to 63.9 billion yuan, or 0.71 yuan a share, from 73.2 billion yuan, or 0.81 yuan a share, in 2011. Sinopec blamed the tumbling price of its chemical products.

CNOOC said earlier this month that rising exploration costs and a new resource tax were mainly responsible for the 9.3 percent fall in its 2012 profit.

PetroChina said last week its profit fell 13 percent to 115.33 billion yuan from 132.96 billion yuan in 2011, in spite of a 9.6 percent increase in revenue generated from increased oil and gas output.

Vice-President Sun Longde said that government price controls dampened its margins, especially natural gas.

The company's natural gas and pipeline business lost 2.11 billion yuan in 2012, compared with a 15.5 billion yuan profit in 2011.

In China, oil and gas companies cannot fully pass on higher crude oil costs to customers, because prices are set by the government.

The National Development and Reform Commission sets prices based on the 22-day moving average of a basket of crude. On Feb 25, China raised fuel prices for the first time since September, increasing gasoline prices by 300 yuan per metric ton and diesel by 290 yuan.

This year might be easier for the big three as the government has vowed to reform the country's pricing system, especially in the fields of energy and resources.

Local media reports said that the price of natural gas could increase by 10 to 20 percent in parts of the country in April.

"PetroChina, as the nation's biggest natural gas producer, is set to benefit greatly from the natural gas price reform," Goldman Sachs said in a report earlier this month.

Sinopec President Wang Tianpu said: "Fuel prices were raised in the second half of last year, which helped Sinopec reverse losses in its refining business.

"I believe that situation this year will be similar to that in the second half of last year. If the government continues its reform of the fuel price formation system, Sinopec stands to benefit," he said at a news conference in Hong Kong.

Last year, the three oil companies all made strides in their internationalization, which they hope can help diversify production and revenue, and mitigate profit swings.

PetroChina's overseas oil and gas production grew 13.3 percent to 137 million barrels of oil equivalent in 2012. Its overseas profit stood at 32.67 billion yuan, accounting for 19.6 percent of its total profit.

CNOOC's overseas production was 75.4 million barrels of oil equivalent in the same period, and its $15.1 billion takeover of Canadian oil and gas company Nexen is expected to significantly boost its overseas output.

Sinopec lags a little behind in overseas expansion. Its output outside China stood at 21.68 million barrels of oil equivalent last year, an 18.1 percent increase year-on-year. To boost its overseas earnings, Sinopec announced on Monday that it plans to pay $1.5 billion for overseas oil and gas-producing assets held by its parent company.

gaochangxin@chinadaily.com.cn