Less proves to be more for Poly Group

Chen said Poly Group has become so big, so fast not because it is an SOE and supported by the central government, but because it has immersed itself in the fierce competition of a market economy and followed effective strategies over the past 15 years. It will continue to adhere to the strategy of limited diversification, he said.

Unlocking the commercial value of the group's four major industries is not easy, considering the turbulence and changes in the global economic environment. Chen said that in the long run he expects Poly Group to maintain reasonable growth.

"Despite the challenges of changing macro-economic policies, and even some restrictions from foreign governments when we go abroad, we are bullish about the group's growth. Our optimism stems from the belief that the four major industries are quite profitable and there is still a lot of potential to be tapped."

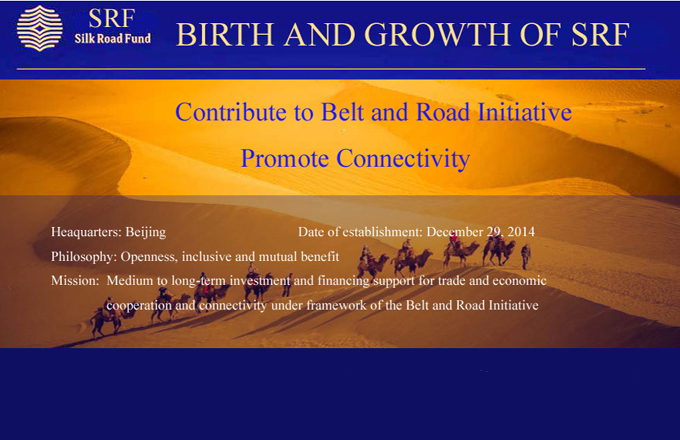

To realize its targets, Poly has a few ideas up its sleeve, including developing its own financial investment company, tapping international markets further and even introducing foreign investors to diversify its ownership.

Its assets are now worth nearly 400 billion yuan and the volume of its loan balance is 120 billion yuan, "as huge as a small bank", according to Chen, which shows that the group is capable of developing its own financial business.

In terms of the international market, Poly has invested a great deal in overseas mineral resources. The group has also operated construction projects in some African countries.

Though revenue from its international activities is not big compared with its gigantic assets as a whole, with the growth of the group's overseas construction projects, its international trading business will continue to grow, Chen said.