Getting intervention right will take careful targeting

By Mike Bastin (China Daily) Updated: 2014-04-08 07:25Not just for the first time this year but perhaps for the first time since the immediate aftermath of the global financial crisis of 2007-08, the Chinese central government appears to have acted decisively to arrest what could be an unacceptably rapid economic slowdown.

Despite the considerable national and international media attention attracted by this recent intervention by Beijing, specific measures introduced recently appear to amount only to further tax cuts for small business, greater investment in rundown urban areas and an acceleration in the construction of a few railway lines.

|

|

|

|

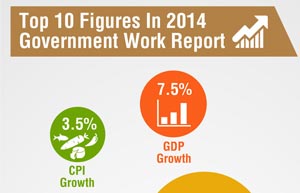

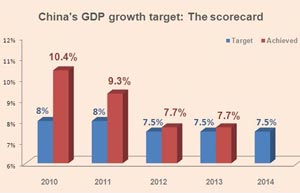

In spite of recent figures growth is still on course for somewhere in the region of 7 percent. On the face of it this figure may appear to represent quite a major slowdown in China's meteoric economic rise over the last 20 to 30 years but, when compared with growth forecasts around the world, it commands considerable admiration and respect. Despite some sort of global economic recovery the world's most-developed countries are not predicted to experience GDP figures that even approach China's 7 percent plus.

Even Germany, still widely recognized as the major engine of European growth, is only facing a growth forecast of 1.7 percent. The US cannot do much better with only 3 percent growth forecast for this year. However, the most telling differential is that between China's 7-7.5 percent likely growth for this year and the overall world economy average forecast of only 2.5 percent.

In a nutshell the Chinese economy should outperform the world economy this year at three times the latter's average growth rate. That said, when double-digit growth was recorded nearly every year between 1999 and 2011, recent economic data do require close attention and careful, limited and targeted government intervention.

|

|

|

- Jaguar F-Type Coupe on track

- German companies upbeat on China's future growth

- Opel to launch small electric car by 2017

- Audi may keep adding output in 2nd quarter

- Samsung's lackluster Q1 earnings meet expectations

- Vice-minister calls for logistics improvement

- Printing firms write new path to profit

- Shanghai to be 2nd Tingyi headquarters