Time to focus on growth quality, IMF says

By Emma Dai in Hong Kong (China Daily) Updated: 2014-04-29 09:00"China is addressing the leverage and shadow banking issues with a series of structural reforms," he said. "It won't be easy, but we hope problems can be solved gradually."

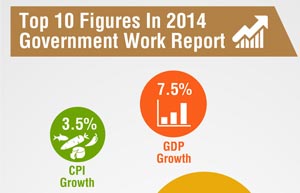

Separately, the State Information Center said on Monday that the nation's economy, particularly the property sector, faces strong downward pressure. The center, which is a central government think tank, said pressure will persist during the current quarter, with GDP growth of about 7.4 percent.

The report suggested implementing a proactive fiscal policy and speeding up investment in urban renovation and rail projects in central and western China. It also proposed a reduction in banks' reserve ratios to increase short-term liquidity when necessary.

"The downtrend is the outcome of tighter monetary and fiscal policies, as well as the pursuit of structural reform," the report said.

The SIC estimated retail sales will expand 12.6 percent in the second quarter, while growth in exports and imports will be about 7 percent and 6.5 percent, respectively.

It said there will be "modest" inflation this quarter, with the consumer price index up 2.3 percent and the producer price index declining 1.1 percent.

Rhee said that China is more likely to use small-scale stimulus measures, where necessary, than a large package.

"The government has learned its lessons. Instead of investing in real estate, it probably would focus on healthcare, education and other areas that don't suffer from oversupply," he said.

"The government also realizes the importance of stabilizing the property market," Rhee added. "While there is no sign of prices declining in big cities, we expect soft landings in third-and fourth-tier cities, where the authorities might try more measures."

The IMF indicated that China's slowdown will have an impact elsewhere in the region, especially economies that depend on China for final goods and services exports. Such countries might include South Korea, Malaysia and Thailand.

The IMF said that a decline in China's growth rate of 1 percentage point might cut that of Asian economies by about 0.3 percentage point. The impact on members of the Association of Southeast Asian nations is expected to be the largest at more than 0.35 percentage point.

|

|

|

- S China footwear factory resumes production

- DS to drive China-made cars overseas

- Brunei, China sign carbon steel pipe project

- Third party mobile payment thrives

- Alibaba takes youku stake

- Time to focus on growth quality, IMF says

- CNR on straight line to success in emerging markets

- Shanghai alleyways attract visitors