Linking HK, Shanghai markets lauded as global boost for RMB

By Emma Dai in Hong Kong (China Daily) Updated: 2014-04-30 07:32

|

|

Hong Kong Exchanges and Clearing Limited Chief Executive Charles Li speaks to participants to provide information on the key features of the Shanghai-Hong Kong Stock Connect in Hong Kong Tuesday, April 29, 2014. [Photo/dfic.cn] |

The Hong Kong bourse chief said on Tuesday that linking the Shanghai and Hong Kong stock markets will boost the offshore usage of the yuan.

"The connection is a milestone in opening up China's financial markets. It will attract a broader international and institutional investor base to China and enable Chinese investors to diversify their portfolios," said Charles Li Xiaojia, chief executive of Hong Kong Exchanges and Clearing Ltd.

Earlier this month, the China Securities Regulatory Commission said it would begin a pilot program for cross-market stock trades for mainland and Hong Kong investors in an effort to liberalize capital flows.

|

|

|

Li said the pilot program is slated to begin operations in six months.

"As large amounts of trading will be done in RMB, Hong Kong's offshore RMB business will go beyond trading in goods and bank deposits. The investment activities will increase the circulation of offshore yuan," Li said.

Under the plan, all settlements will be made in yuan and all currency conversions will be made offshore. Domestic investors will change their yuan in Hong Kong and overseas investors have to buy A shares with offshore yuan. The move was announced by Premier Li Keqiang on April 10. The program is officially called the Shanghai-Hong Kong Stock Connect and allows both Hong Kong and mainland investors to trade stocks listed on either bourse.

Li disclosed on Tuesday that there will be a price-matching pool in Shanghai for A shares and another in Hong Kong for H shares. Only the net settlement will change hands between the two sides.

Trading in both markets will follow local regulations. A 10-percent price limit on closing prices from the previous day in the A-share market will still apply to international investors. The Hong Kong Stock Exchange does not employ such a rule.

Li said the Hong Kong bourse will work out operation details in the next two to three months.

"It's highly probable that important international indices will consider China's weighting very differently in the short term with this program. Should they decide to reflect China's domestic A shares heavier in certain indices, there will be significant impact on funds tracking these indices."

- China's listed firms report rising profits for 2013

- Live poultry markets to be closed

- $800m more to be invested in Shanghai Disney park

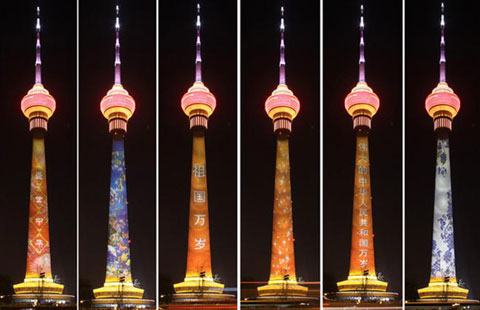

- Chinese cities' four modernizations

- Chinese tourists will come of age

- Li calls for west China to welcome new firms

- China's farmers feel deflationary chill

- Shanghai Pudong Development Bank to sell preference shares