Chief feels upbeat about future

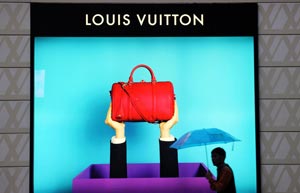

By Xu Junqian in Shanghai (China Daily) Updated: 2014-05-15 10:37Chinese consumers are increasingly sophisticated. They travel and shop overseas. The domestic market is losing its sheen and an increase in the number of luxury products given as gifts is slowing. Possibly halting.

|

Jonathan Seliger, president and CEO of Coach China

|

Consulting firm Bain & Co painted a gloomier picture, estimating the growth rate of China's luxury market will stick at 2 percent in 2013, down from 7 percent the previous year and 30 percent in 2011.

"We can fill that gap. We are incredibly optimistic about the future of China," Jonathan Seliger, president and CEO of Coach China, said.

He said a 30-new-store plan this fiscal year in China is "very aggressive" in the luxury world.

|

|

|

But Coach Inc is not alone in eying and developing a growing market share.

Newcomers like Tory Burch LLC and Michael Kors Holdings Ltd are aggressively carving up the market in China with similar, if not the same, positioning.

"The problem with our positioning is we actually have a very wide range of competitors," Seliger said.

The Coach brand used to compete with and take market share from traditional European luxury brands by "neighboring" them on the grand floor of major shopping malls in China. It's now been "neighbored" itself in recent years in what is the world's fastest growing luxury market.

According to a report by Cowen Group Inc, female shoppers' preference for Coach has decreased.

The New York-based financial services provider released its Cowen Consumer Tracking Survey in January. It showed 39 percent of women aged 18 to 34 preferred Coach over Michael Kors in December. That's down from 46 percent in 2012's holiday season.

Devotees of Michael Kors, rose to 24 percent last year from 20 percent in 2012.

|

|

| Top 10 favorite luxury brands of Chinese women |

- Standard Chartered offshore RMB index rises slightly in July

- Shanghai-HK stock link to speed up capital market reforms: Barclays

- Relaxing restrictions on foreign investments

- Fujian on course to help create the new maritime Silk Road

- Foreign investors set sights on new targets

- UK looks to diversify in China

- Malaysia keen to expand trade ties

- HK still top choice for mainland firms