Yellow metal loses sheen as global economic risks recede

By Wu Yiyao in Shanghai (China Daily) Updated: 2014-06-04 06:58Investors need to clarify their investment goals and keep their risk tolerance in mind so they can make informed decisions, said Xue.

Sun Taoxian, a 46-year-old physician in Shanghai who has about 10 percent of her savings in gold bars, said that investment in bullion has become "more challenging" as the price becomes more volatile.

"I may learn more about gold trading. In the past, I just put the bars in the safe deposit box and didn't think further about the price," said Sun.

According to the China Gold Association, the nation's gold purchases totaled 323 metric tons in the first quarter, up 0.76 percent year-on-year. Of the total, 232.5 metric tons went into jewelry, a 30.2 percent year-on-year increase.

Consumption of gold bars accounted for only 67.95 metric tons, down 43.5 percent year-on-year.

According to the World Gold Council, global demand was "robust" in the first quarter, marking a return to the long-term quarterly average demand trends established over the previous five years. Following an exceptional year in 2013, first-quarter demand was virtually flat at 1,074 metric tons.

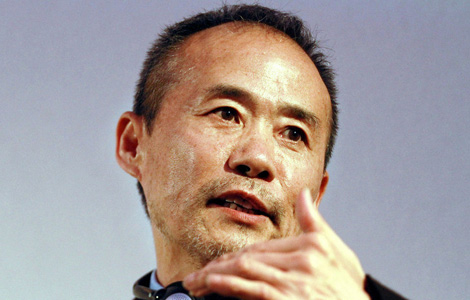

"The first quarter of 2014 signals a return to the long-term average pattern of demand, holding steady at 1,074 metric tons. It is clear that the longer term underpinning of the gold market such as jewelry demand in Asia remains firmly in place," said Marcus Grubb, managing director of investment strategy at the council.

|

|

|

| Did Chinese dama lose big on gold? | Dama dames: China's secret weapon |

- Training seminar to aid industrial transferring into Africa

- Pingtan pilot zone releases negative list

- Mobile health initiative set to take off in China

- Taste Austrian chocolate in Shanghai

- China welcomes US greenhouse gas plan

- US abuses trade remedy measures: MOC

- China dissatisfied with US plan to slap high duties

- China all set to grow as 'megatrader'