China all set to grow as 'megatrader'

By Mike Rees (China Daily) Updated: 2014-06-04 07:39Third, China's powerful role in world trade is not just about its exports. China now has the largest share of demand for most commodities, except oil where it is second only to the US. China's focus on more balanced growth and structural reforms will over time drive up domestic consumption, making it an even more attractive market for global companies and emerging market exporters.

Take the example of Apple again - with units once assembled in China and sold in the West - China is now the second-largest market for Apple products, and Apple expects it to overtake the US soon.

Economic reforms set in motion by China's leadership are also likely to strengthen the private sector in China, opening up many more joint venture opportunities for global companies.

Overall, we expect China's trade to double in size by 2020, with the next phase likely to come from massively growing trade with other emerging markets. Further out, to 2030, the World Trade Organization sees China's share of world trade to rise to 20 percent or more, underscoring the central role of China in global trade.

As a "megatrader", China will increasingly have a vested interest in promoting free trade, gradually opening up to more imports to satisfy consumer demand and keep trading partners happy. Moreover, China will remain heavily dependent on importing raw materials. Over time, it could - like Britain in the 19th century or the US after 1945 - become a champion for liberalizing world trade.

What does this mean for corporate houses? It means that those who don't already have a strategy for China, and more broadly for emerging markets, need to get one fast.

Already compelling, the argument for including the yuan in your basket of global trading currencies will only grow stronger. Having climbed steadily up the rankings, the yuan is currently the world's seventh most used currency for payments, and predicted to be the fourth - after the dollar, the euro and the pound - by 2020.

By 2020, we expect 28 percent of China's trade to be denominated in the yuan, the equivalent of some $3 trillion a year. The vast Chinese commodities imports, for example, will gradually convert to yuan settlement.

Companies will need to work out how best to position themselves for the growing "South-South" trade - or trade between emerging markets - particularly trade involving China. This will affect not just where they make their goods, but how they make them as they cater for a new and rapidly growing group of Chinese and other emerging market consumers.

The slowdown in China's economic growth - and recent data sparking uncertainty about the country's trade performance - should not be allowed to distract from what is a very clear long-term trend: China's status as a "megatrader" will continue to grow and businesses everywhere should be figuring out how to make the most of it.

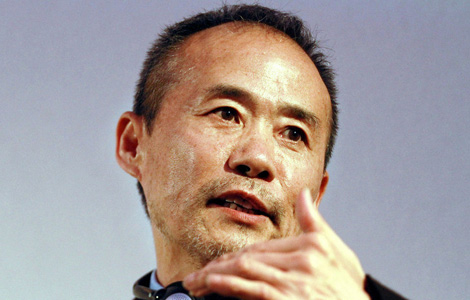

The author is deputy group chief executive of Standard Chartered.

|

|

|

| China's foreign trade down 0.5% in Jan-April | China's foreign trade down 1% in Q1 |

- Mobile health era coming, challenges ahead

- Taste Austrian chocolate in Shanghai

- China welcomes US greenhouse gas plan

- US abuses trade remedy measures: MOC

- China dissatisfied with US plan to slap high duties

- China all set to grow as 'megatrader'

- US sets preliminary subsidy rates on China's PV products

- China-made hybrid engine to power Toyota