New listings set to cheer bourses

By Xie Yu in Shanghai (China Daily) Updated: 2014-06-26 07:03|

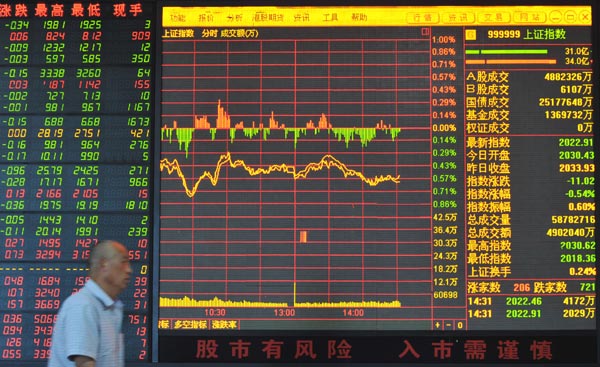

The benchmark Shanghai Composite Index drops 0.41 percent to 2,025.50 on Wednesday, and turnover shrinks to 56 billion yuan from 61.7 billion yuan on Tuesday, on eve of the trading of new shares. Lu Qijian / For China Daily |

Low valuations, anticipated high returns to lift investor sentiment

New share listings are expected to lift investor sentiment on Chinese bourses, with the current low valuations providing enough room for higher future returns, market analysts said on Wednesday.

Trading in the shares of the newly listed Wuxi Xuelang Environmental Technology Co, Shandong Longda Meat Foodstuff Co, and Feitian Technologies Co, is expected to start in Shenzhen on Thursday, the Shenzhen Stock Exchange said in an announcement on Tuesday night. The initial public offerings of the three companies marked the resumption of IPOs on Chinese bourses after a long hiatus.

Ten companies planning IPOs had already announced their offer prices by Monday, the China Securities Regulatory Commission said in a statement on Tuesday, adding that the average price-earnings ratio of these is 17.76, or about 39 percent lower than the average of the 48 IPOs at the start of this year.

"The regulators have managed to keep the valuations at relatively low levels. This will prevent liquidity drains and sharp price declines on the secondary market," said Zito Ji, an analyst with a Shanghai-based mutual fund.

"With the IPO prices of the new entrants at levels that are lower than their peers, there is more than enough room for price appreciation after trading starts on the secondary market," he said.

|

|

|

| Driving school steers toward a Shanghai IPO | Stocks dip, foreign investment slows |

- China-made air carrier starts commercial operation in Nepal

- HK's low-cost airline to expand mainland routes

- China leads in trade of renewable energy products

- China faces tough task in energy revolution

- Set-top box content under govt scrutiny

- China's external financial assets surpass $6 trillion

- China to increase FX derivatives

- Bigger Apple iPhones said to start mass output soon