On this beach no one is naked

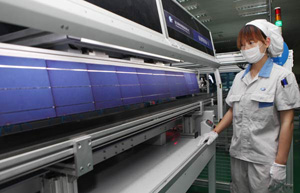

By Zheng Yangpeng and Yuan Hui (China Daily) Updated: 2014-10-10 10:23Through a glass screen in the factory, a few workers can be seen operating a forest of mono-crystal furnaces. Managers say that when the factory opened, one worker took care of three to four furnaces. Now one can operate 12 simultaneously, thanks to automation.

The company says that as a result of that and other efficiency improvements it was able to raise salaries in 2011 and 2012.

The factory has also benefited from a low power tariff, of 0.47 yuan ($0.0766; 0.06 euros) a kilowatt hour, which is one of the main reasons the company decided to locate the factory in the city. By comparison, the tariff for industrial electricity in Tianjin is between 0.8 and 0.9 yuan a kW/h, and the price can exceed 1 yuan a kW/h in coastal regions such as Zhejiang and Fujian.

"Of course, other regions have favorable tariffs, too," Pan says. "The difference is that businesses get favorable pricing through subsidies. But governments cannot afford these if huge amounts of power are being used. Here we don't need such subsidies."

The company is now focused on developing monocrystalline silicon, believing solar cells made of that will overtake those made of polysilicon, which at the moment account for a larger share of solar cells sold in China.

In the industry generally the focus has switched from reducing required investment per watt of electricity to lowering production costs per kW/h, Pan says, and in this regard monocrystalline silicon-made cells have an advantage.

Tianjin Zhonghuan is also seeking to expand its activities in Inner Mongolia to power generation. With SunPower Corporation, a US company that has expertise in high-efficiency solar cells, Zhonghuan was able to produce SunPower's proprietary C7 solar cell receivers, which will be installed in PV stations that enable a conversion rate of 25 percent or more, the highest in the world.

Huaxia Concentrated Photovoltaic Power, a joint venture between Zhonghuan, SunPower and local companies, has been given the green light to build a 20 megawatt solar farm in Hohhot and a 100 mW one in a neighboring county, both of which are expected to be completed next year.

The farms will use third-generation technology that reflects light onto solar cell receivers, concentrating the sun's energy seven-fold.

Exports still account for 70 percent of Zhonghuan's sales, but its export destination countries have changed, once dominant Europe having been replaced by South Korea, the Philippines and Malaysia.

Another major company in the Jinqiao zone, Orisi Silicon Co, produces mainly polysilicon that it only sells in China. The company is a subsidiary of China Aerospace Science and Technology Corporation, a state-owned conglomerate, and Orisi also sells its products to other China Aerospace offshoots.

"A score of customers buy up what we produce," says Ma Jiangong, a manager with Orisi. "In the first eight months of this year our sales grew 76 percent compared with the corresponding period last year."

The domestic market has lost some of its significance as fewer PV units have been installed, putting a dampener on the price of polysilicon. Ma says that despite rapid first-half growth he is pessimistic.

He has called for central and regional governments to step up support for enterprises' technology innovation in an effort to drive down production costs.

Zhonghuan and Orisis epitomize the PV industrial cluster gradually taking shape in Hohhot. The city, an emerging economic hub on the Mongolian plateau, is creating an industrial chain that promises to reduce the city's traditional reliance on the petrochemical industry.

|

|

|

| Solar industry powers up sales | PV firms go green with solar farms |

- China's Baidu buys control of Brazil's Peixe Urbano in expansion push

- Deutsche Telekom and China Mobile to sign 'connected cars' deal

- Online purchases get a 'smart' touch

- China to allow individuals to invest abroad

- Beijing not to ease home purchase restrictions

- Banking on growth in mobile tech

- Domestic firms getting an edge in stake sales

- Huawei makes to world's top 100 brands list