China's family companies bullish on business outlook

By Cai Xiao (China Daily) Updated: 2014-10-22 09:03

Chinese family enterprises have seen much stronger growth than the global average and are bullish about growth in the next five years, PricewaterhouseCoopers said in a report on Tuesday.

The survey was conducted by interviewing top executives of 2,848 family companies in more than 40 countries, each with annual sales of $5 million to $1 billion.

More than 80 companies in the survey were from China, and they were mainly in manufacturing, retail and commerce, PwC China Consulting Partner Roger Ng said.

|

|

| Family farms see huge jump in earnings |

|

|

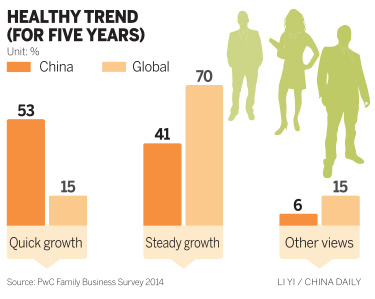

| Family firms help maintain growth impetus |

Among the respondents from China, 84 percent of family businesses reported business growth in the last financial year, compared to the global figure of 65 percent. Optimism was high, with 53 percent aiming for quick and aggressive growth in the next five years, while the figure globally was 15 percent.

"In general, family businesses in China are in reasonably good shape in terms of growth," said Jean Sun of PwC.

Similar to their global peers, China family business executives ranked staff recruitment and market conditions as the key internal and external issues that they face in the next 12 months.

Over the next five years, Chinese respondents identified innovation, professionalization and attracting quality staff as their top three challenges, with less emphasis on price competition.

"Among Chinese respondents, sustaining long-term growth is the most important for the next five years, which is driven by the factors of being more innovative, running business more professionally and attracting talent," said Sun.

The survey indicated increased internationalization in the family business area. In China, 15 percent of sales are accounted for by international sales, and the ratio is expected to rise to 21 percent in the next five years.

Looking at family members' involvement and succession plans, the survey found that more than 80 percent of Chinese family businesses have board members who are not relatives, compared with 34 percent globally.

In China, 22 percent of family businesses have some sort of succession plan, while only 6 percent have a robust and documented succession plan in place, lower than the global average of 16 percent.

"Family businesses in China seem to be more poorly placed than average in terms of the procedures they have in place to tackle family conflicts and the succession plan," said Richmond Li, who specializes in Chinese tax issues at PwC.

Li said that might be because family businesses are still at the early development stage and may lack the experience to develop a comprehensive succession plan.

- Chinese vice premier meet with Apple CEO

- China treasury bond futures close lower Wednesday

- Wind power capacity nears China's development target

- China stocks close lower Wednesday

- China's lottery sales up 25.2%

- Forbidden City's Taobao store hot on the Internet

- Aegon formed JV for life insurance in China

- More deals are expected in Beijing's office market