Medtech to see robust growth

By Wang Wen (China Daily) Updated: 2014-10-30 07:25

|

|

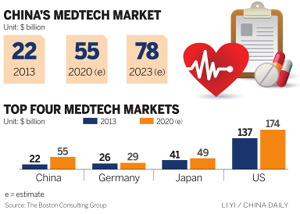

A visitor tries a device for the treatment of cervical vertebra problems at an international health industry expo in Beijing. The medtech market, including instruments and equipment, was valued at $22 billion in 2013. [Provided to China Daily] |

Aging numbers and middle class growth driving the demand for medical devices

China will become the world's second-largest medical technology market with a value of $55 billion by 2020, The Boston Consulting Group said in a report released on Wednesday.

The medtech market, including instruments and equipment, will have a compound annual growth of 14 percent on average from 2013 to 2020 and its global share will increase from 7 percent in 2013 to 12 percent by 2020, said the report titled "Winning in China's Changing Medtech Market".

The accelerated aging of Chinese society, the increased incidence of chronic and serious diseases, an expanding middle class, the emergence of more small to medium-sized cities and increasing government spending on healthcare are the fundamentals driving China's medtech demand, said Luo Ying, a BCG partner and co-author of the report.

"China's medtech industry is very different from 10 years ago and the market will also be very different in the next 10 years," Luo said.

As the market grows, changes will occur. First, the importance of the middle segment of the market will increase, but it will also be the most competitive, said the report.

Lower-tier urban hospitals are the main customers of medical technology in the middle segment of the market, and they are both price- and quality-sensitive, Luo said. "Many local manufacturers perform well in the middle segment of the market."

Local companies will gain in the premium segment on the strength of government support for technological innovation, although foreign companies will still dominate the top end with more advanced technology, said the report.

Li Bin, minister of the National Health and Family Planning Commission, said in August that the government encourages major hospitals to use domestic medical equipment.

Some senior managers from well-known hospitals have said they will purchase more domestic equipment and support the industry's development, the commission said in a statement on Oct 8.

"Local companies need to upgrade their product focus from low-end and competing just on cost to mid-end and competing on quality as well as cost, and possibly even innovation," said John Wong, senior partner of BCG and co-author of the report.

To respond to the changing market, foreign companies must modify their strategies, Wong said. As the middle segment of the market grows fast, foreign companies, which target the high-end market, need to rethink their portfolios and obtain share in the middle tier through local product development or acquisition, he said.

Some foreign companies have already taken such steps.

General Electric Co, which has an "in China for China" strategy, established four research and development centers and six other facilities across the country to design and manufacture mid-end products especially for the local market.

Other foreign companies have sought to grow in China through acquisitions. For example, Medtronic Inc, one of the main medical technology manufacturers based in the United States, spent approximately $816 million in 2012 to purchase China Kanghui Holdings, an orthopedic device maker from China.

"The integration of Kanghui provides Medtronic with a strong position in China's rapidly expanding orthopedics segment," said Chris O'Connell, executive vice-president of Medtronic's restorative therapies group, including the spine, neuromodulation, diabetes and surgical technologies businesses.

The US company also expanded its strategic alliance in July with Lifetech Scientific Corp, a medical device company in China, to include jointly produced Lifetech pacemakers made in and for China.

|

|

|

| Nutritional supplements a thriving market | Medical sector a lure for foreign players |

- More foreign banks arrive as Chengdu becomes financial hub

- Shenzhen sees biggest rental increase in Q3

- Beijing water plant ready for water diversion project

- Fed announces end to quantitative easing stimulus, keeps low rates

- World’s first wearable air purifier to meet public

- Gold sharply down as Fed ends bond buying

- Xiaomi taps 29 banks for $1b loan

- China witnesses remarkable drop in undernourishment rate