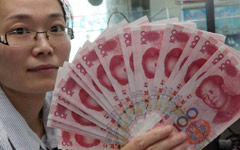

Yuan's footprint expanding quickly in Africa

By Li Lianxing in Nairobi, Kenya (China Daily) Updated: 2014-11-18 09:19Currency more widely used in trade transactions and foreign reserves; leading Uganda bank joins trend

Uganda State Minister for Industry James Mutende recently converted about 4.4 million Ugandan shillings to 10,000 yuan ($1,630) at a Stanbic Bank office in the capital of Kampala. At the same counter, Zhao Yali, Chinese ambassador to Kampala, exchanged 500 yuan into the local currency.

Those transactions were a sign that the renminbi has become a convertible currency through Uganda's Stanbic Bank, a unit of Standard Bank of South Africa Ltd.

|

| Cross-border yuan settlement rising: BOC report |

|

| Banks expect cross-border yuan use to accelerate |

The internationalization of the renminbi in Africa has been led by major Chinese banks and their partners including Bank of China Ltd and payment services company China UnionPay in recent years. But for the first time, a local bank has taken the lead.

Stanbic Bank, through its parent and a strategic partnership with Industrial and Commercial Bank of China Ltd, provides unique opportunities for its customers by allowing them to leverage the banks' extensive networks to conduct transactions across China and Africa.

Standard Bank Group is the largest bank by assets in Africa, and ICBC is its biggest shareholder. For the African country, the use of the Chinese currency makes a lot of business sense.

China is Uganda's largest trading partner, with annual bilateral trade of about $570 million. The use of the yuan in settlement will support the growth of Sino-Uganda trade, said David Wandera, head of global market sales at Stanbic Bank Uganda Ltd.

Previously, importers had to convert dollars into the yuan to pay for goods from China, which meant multiple exchange-rate risks.

"By providing a direct exchange from the shilling to the yuan, we can reduce transaction costs associated with multiple currency conversions. We believe transaction costs can be reduced by up to five percent, and this can be the difference between a viable and non-viable business," Wandera added.

There have been increasing business links between China and Uganda, especially in the energy and infrastructure sectors, with the government of Uganda investing heavily in these areas. There are growing opportunities for Ugandan exporters to China in horticulture, coffee, tea, tobacco and leather products.

Uganda is not the only African country where the yuan is gaining ground. Nigeria, Tanzania and Zimbabwe have diversified the composition of their national reserves to include the yuan.

Transactions in the yuan have become a regular business for many local banks in Mauritius. In the Democratic Republic of Congo, a renminbi-denominated card can be used in any local bank that has a partnership with China UnionPay.

The Chinese currency is bound to change the landscape of the international financial system. Its internationalization will benefit Africa as financial authorities on the continent seek more diversified currency baskets that will reduce the risks of exchange-rate volatility.

Also, because China is poised to become the biggest investor in Africa, the yuan's internationalization will open more business opportunities for African countries in world markets.

China is the biggest trading partner of the African continent, and it enjoys a favorable balance. But now Africa's exports to China are increasing and more African entrepreneurs are seeking business and investment opportunities in China. Adding all these factors up, a convertible status of the yuan in Africa is a win-win situation.

- Cash crunch fans expectation on RRR cut

- US extends antidumping duties on China's thermal paper

- Modern food van with ancient look in Shanghai

- China home prices continue to cool in November

- Asia's top 3 billionaires all Chinese

- Old investment remedy the treatment for China's "new normal"

- China's solar sector opposes US anti-dumping ruling

- BMW to recall 846 cars in China