Curbs on banks' yuan trading to be relaxed

(Agencies) Updated: 2014-12-31 07:08While position caps for shorting dollars will remain unchanged, the SAFE has published standards for total forex positions that will apply to everyone.

Banks previously needed to apply for quota individually.

All banks with less than $100 million worth of forex settlement business in the previous year will be allowed total positions of $50 million on average by the end of each day in a week, with a maximum short position value of $3 million, according to the new rules.

Those recording a value between $100 million and $1 billion will be granted total positions of $300 million and short positions of $5 million.

Those doing more than $1 billion of business can have total positions of $1 billion and short positions of $10 million.

"Those banks that cannot meet their business demand via the above-mentioned positions can apply to SAFE for additional quotas," the regulator said.

The rules also apply to China-based foreign banks; overseas lenders that have more than one office in China must appoint one key office to manage the positions, the rules said.

RMB exchange rate to be stable in 2015

The renminbi exchange rate will remain stable in 2015, a macro economic report from China International Capital Corporation (CICC) predicted on Dec 29.

"Despite the weaker spot exchange rate of the renminbi against the dollar, the appreciation of the central parity rate highlights the People's Bank of China's policy intention to stabilize the exchange rate," said the report.

China recorded a current account surplus of $152.7 billion in the first three quarters of 2014, which represented 2.2 percent of the GDP. The figure is expected to rise further to 3 percent in 2015, according to CICC.

China also recorded a large capital account surplus of $68.7 billion over the first three quarters of 2014. With China's economic risk falling, it is expected that the country will continue to run a capital account surplus in 2015. Twin surpluses should help support the renminbi exchange rate against the dollar, said the CICC.

CICC forecast that the central parity rate for renminbi against the dollar will be 6.13 at end-2014 and the spot exchange rate 6.22. The central parity rate is expected to be 6.11 at end-2015 and the spot exchange rate to be 6.20.

The value of the renminbi weakened by 19 basis points to 6.1205 against the US dollar in its central parity rate on Monday, according to the China Foreign Exchange Trading System.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day. The central parity rate of the yuan against the US dollar is based on a weighted average of prices offered by market makers before the opening of the interbank market each business day.

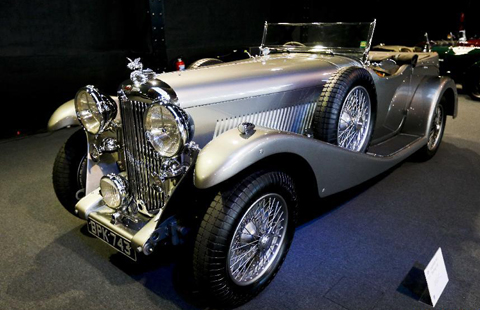

- Aston Martin holds 100th anniversary exhibition in Brussels

- Partnership brings together best in food safety standards

- China non-manufacturing PMI rises in December

- China's December manufacturing PMI retreats

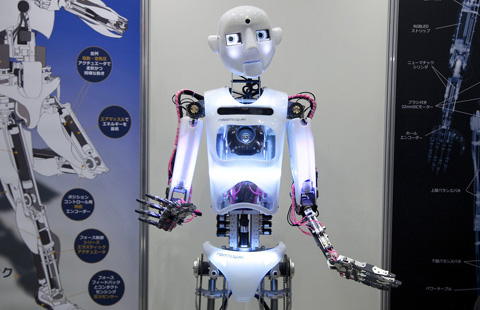

- Top 10 jobs that are likely to be replaced by robots

- Tougher regulation urged on use of additives

- Look out, there's a robot just waiting to take over your job

- Tech giants compete for healthy consumers