China opens futures market to overseas traders for specified products

(Xinhua) Updated: 2015-01-01 13:59BEIJING - China's Securities Regulatory Commission (CSRC) will allow overseas traders and agencies to trade specified futures products in the domestic market in an effort to enrich the diversity of the market.

The CSRC will provide multiple channels for overseas traders to participate in the domestic market and standardize operations including account opening, transactions, deposits placement as well as measures to cope with defaults and disputes.

The CSRC has also specified measures to deal with illegal practices and cross-border law enforcement for the scheme, according to an interim guideline issued by the CSRC.

The CSRC has approved crude oil futures trading at Shanghai International Energy Exchange, a subsidiary firm under the Shanghai Futures Exchange, which will introduce overseas traders and agencies.

It said the guideline was issued regarding this development.

The CSRC also said the interim guideline will be subject to public opinions and suggestions before it takes effect.

- China's harsher environmental protection law to take effect

- China's central bank stresses prudent monetary policy

- China standardizes procurement for more transparency

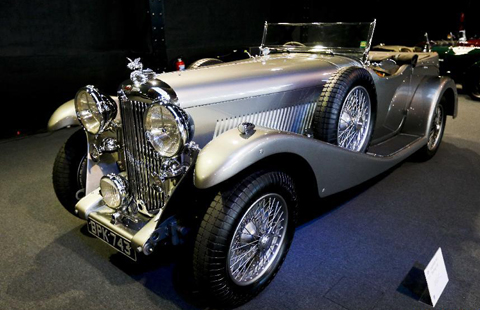

- Aston Martin holds 100th anniversary exhibition in Brussels

- Partnership brings together best in food safety standards

- China non-manufacturing PMI rises in December

- China's December manufacturing PMI retreats

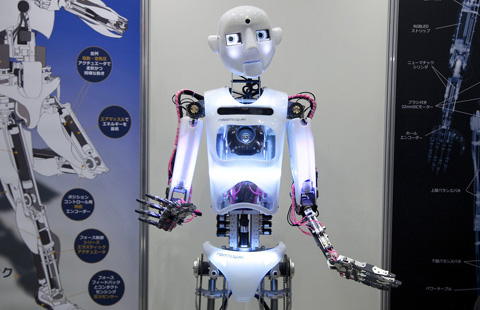

- Top 10 jobs that are likely to be replaced by robots