Stock link bid for HK, Shenzhen

By ZHAO YINAN (China Daily) Updated: 2015-01-06 04:49

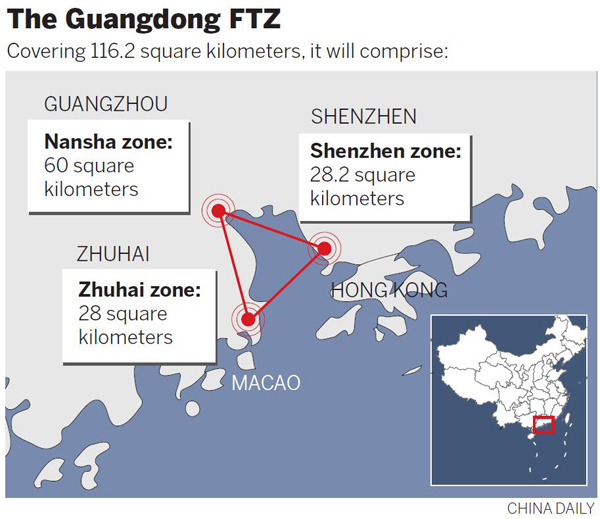

Move designed to integrate Guangdong with China's two SARs

China is considering a stock trading link program to allow Hong Kong and Shenzhen investors to buy and sell shares on each city's bourse.

The move is part of efforts to integrate Guangdong province, the mainland's reform front-runner, with the country's two special administrative regions.

Experts said the proposal, a key step in building the Guangdong Free Trade Zone, will further promote China's financial openness, following the launch of the Shanghai-Hong Kong Stock Connect in November.

Premier Li Keqiang made the announcement on Monday during a visit to Nansha New Area, one of the three areas in the Guangdong FTZ.

"One reason the central government approved the Guangdong FTZ is the geographic proximity to Hong Kong and Macao," he said.

"So the first step in building the FTZ is to deepen integration with the two special administrative regions, where the two sides can well complement each other, especially in the trade of services."

Zhu Xiaodan, the Guangdong governor, proposed issuing a list of areas off limits to foreign investors, as the Shanghai FTZ currently does. He will also issue a shorter list with fewer restrictions on Hong Kong and Macao investors.

The proposed Guangdong Free Trade Zone is modeled on Shanghai's pilot FTZ.

- Holders claim prepaid cards 'useless'

- Let the next smartphone battle begin

- Shanghai office developers running short of prime land

- From tiny to titanic, tech companies strut stuff in Las Vegas

- Firms grappling with compliance talent shortage

- China pushes for SIM card registration in crime crackdown

- Oil slump offers reform opportunity for China

- China's private financing to hit 18t yuan in 2015