China 4th-quarter GDP growth may slow to 7.2%

(Agencies) Updated: 2015-01-07 15:58But analysts say it could take quite some time before construction of planned railways, roads and other projects starts as local governments are burdened by piles of debt.

December factory output likely grew 7.4 percent from a year earlier, quickening slightly from 7.2 percent in November, when many polluting factories in north China were shut for a meeting of Asia-Pacific leaders in Beijing.

Policy easing

The PBOC is widely expected to cut interest rates further or lower reserve requirement ratios (RRR) for all banks, although some analysts believe it may be pausing on policy easing to wait for recent actions to take effect and lift growth.

"The central bank needs time to observe economic operations before taking further easing measures, so the possibility of a near-term cut in interest rates or RRR is not big," Lin Hu, an economist in Beijing for Guosen Securities said in a note.

China's reform-minded leaders have shown greater tolerance for slower growth, but further slowdown in the economy could fuel job losses and undermine public support for changes.

A property slump is expected to last well into 2015, companies will continue to struggle to pay off debt and export demand may remain erratic, leaving the services sector as the economy's lone bright spot.

UBS expects China's GDP growth to slow further to 6.8 percent in 2015, and rising deflationary pressure will spur the central bank to cut benchmark lending rates by at least 50 basis points this year.

Factory price deflation

Highlighting deflationary risks, producer prices may have fallen 3.1 percent in December from a year earlier. That would extend to 34 months a streak of declines that has eroded corporate earnings. November saw a 2.7 percent slide.

Annual consumer inflation likely hovered near five-year lows, at 1.5 percent, in December, leaving some room for the central bank to loosen policy if needed.

Reflecting lackluster domestic demand, China's imports may have declined 7.4 percent in December from a year earlier, following a 6.7 percent drop in November.

Export growth likely accelerated to 6.8 percent in December from 4.7 percent in November. The December trade surplus could be around $50 billion, near record highs.

Retail sales, a key gauge of domestic consumption, were seen expanding 11.7 percent in December from a year earlier, steady from November, according to the poll.

- Panasonic joins trend of reshoring out of China

- 9 websites that provide 'haitao' service in China

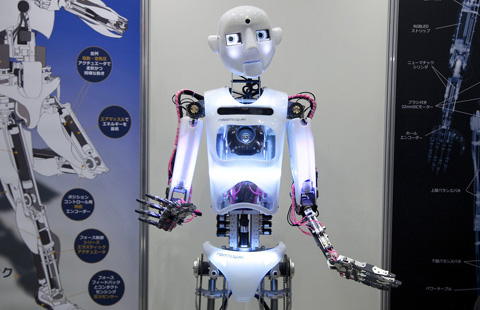

- Chinese tech gadgets shine at International CES

- TCL plans to rejuvenate Palm

- Chinese companies bring back Palm, Motorola brands

- Ex-Infiniti exec joins Leshi for 'super electric vehicle'

- Lenovo wants larger US share

- China's Huawei exhibits over 100 products at 2015 International CES