Local State firms face credit risk

By Jiang Xueqing (chinadaily.com.cn) Updated: 2015-01-13 15:33China will face credit risk outbreak from 2015 to 2016 after local governments classify different types of debt and decide which should be included in the government budget, an economist said on Monday.

Previously, many small local State-owned enterprises could receive bank loans in spite of their poor profitability because local governments explicitly guaranteed repayment of the loans. But now, according to the central government's requirement, local governments can no longer randomly provide guarantee for companies or local-government financing vehicles. So credit risk may expose small local State-owned enterprises, said Yao Wei, China economist at France-based Societe Generale SA.

"The government used to take measures to prevent debt default but such actions did no good to healthy economic development in the long run. The financial market and companies should be aware of a possible burst of credit default risk, which is actually a progress for the Chinese economy," Yao said.

As of Sept 30, the nonperforming loan ratio of commercial banks had reached 1.16 percent on average, according to the China Banking Regulatory Commission, but Yao said she has learned from some bankers and analysts that the current NPL ratio is 5 percent.

She said there is still a lot of room to reduce systemic risk by developing policies to handle local debt while reducing the impact of risk exposure to the real economy.

"For some debt problems caused by central government policies, the central government should be responsible for part of the financial losses, so banks will not be overburdened. Otherwise, it will affect credit growth and have a huge negative impact on the economy," she said.

- Shengjing Global Innovation Awards 2015 launches in Beijing

- Refineries face brunt of tax rise

- Busy week for market as 22 companies set to raise funds

- Toyota ends freeze on expansion, looks at three new plants

- 90% drop in Chengtou notes issuance

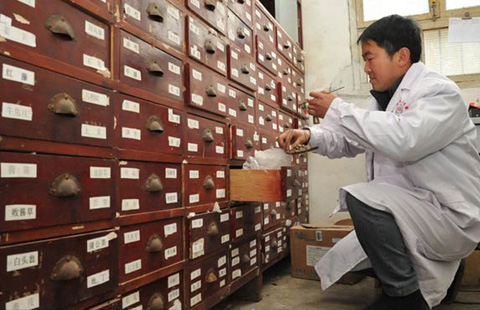

- A day in the life of a village doctor

- Xiaomi's CEO named China's businessman of the year

- Lamando joins ranks of locally produced autos